To accelerate global decarbonization, it is essential to channel more finance into clean energy and other low-carbon investments. Achieving substantial reductions in greenhouse gas (GHG) emissions across the entire economy requires both a large-scale expansion of green or near-green sectors and the growth of “enabling” sectors. These enabling sectors include the manufacturing of equipment (such as wind turbines, solar panels, grid infrastructure, and batteries), the mining of essential metals and minerals, advancements in information and communication technology (ICT), investments in carbon capture, utilization, and storage (CCUS), and the adoption of carbon dioxide removal (CDR) measures.

Additionally, increasing attention is being directed toward “hard-to-abate” sectors (e.g., steel, cement, chemicals, and aviation) that face significant technological and cost challenges in reducing emissions. While hydrogen-based technologies are often seen as key to decarbonizing these emissions-intensive sectors, their feasibility remains uncertain due to the high costs and limited availability of green or abated hydrogen. As a result, enabling measures like CCUS and CDR could play a greater role in these sectors.

Transition Finance to Promote an Economy-Wide Transition

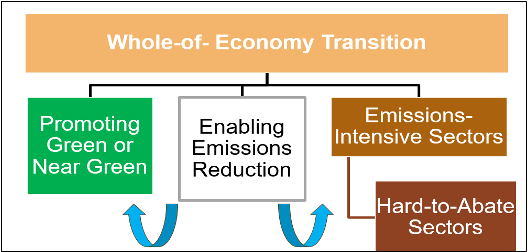

Since some enabling sectors used in both green and hard-to-abate sectors can also be emissions-intensive, it is crucial to drive a transition across the entire economy to achieve net zero (Figure 1). This need underscores the growing use of the term “transition finance,” which describes financing an economy-wide transition rather than focusing narrowly on hard-to-abate sectors alone, as highlighted by the Glasgow Financial Alliance for Net Zero (GFANZ) in its 2023 report (GFANZ 2023; Shirai and Dang 2024a).

Figure 1: Classifying the Whole-of-Economy Transition

Source: Shirai and Dang (2024a).

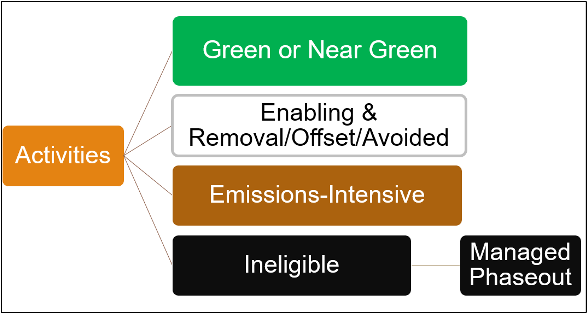

The concept of transition finance for the whole economy could be clarified more effectively by examining the pathway for transitioning the whole economy toward net zero from both an entity (or corporate) level and an activity level, separately (Figure 2). This distinction is important because large companies often engage in activities across multiple sectors, requiring tailored decarbonization efforts for each sector. Such companies may need to adopt various options to reduce the GHG emissions from individual activities, as well as the aggregated emissions from their entire operations and the value chain. Activities can be differentiated by sector, project, technological feature, and asset type (Shirai 2024; Shirai and Dang 2024a).

Figure 2: Classifying the Whole-of-Economy Transition into Entities and Activities

Source: Shirai and Dang (2024a).

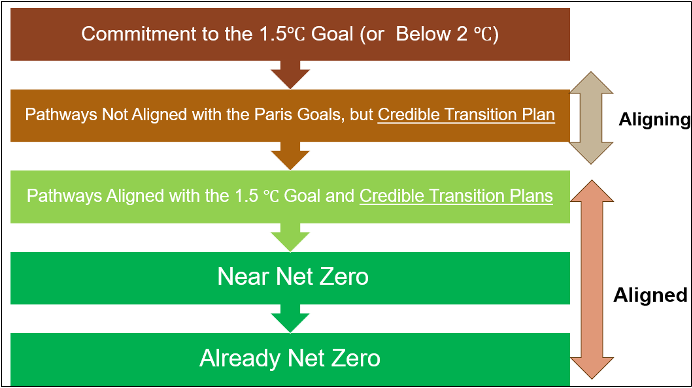

In principle, nearly all entities need to be aligned with net zero targets by around 2050 or the 1.5°C pathways concerning Scope 1 and 2 emissions, and Scope 3 if emissions are substantial. However, the actual decarbonization pathways vary significantly depending on the sector, available technology or advancement of potential technology, cost performance, applicability of CCUS and CDR measures, as well as country-specific circumstances. Globally, most entities are not yet aligned with the net zero target or the 1.5°C pathways (Figure 3). Introducing sectoral decarbonization pathways with credible transition plans can be an important tool, especially for hard-to-abate sectors, to enhance credibility. These pathways have been developed by many organizations, including the Science-Based Target Initiative (2023) and Climate Bonds Initiative (2024). Additionally, some data providers have attempted to assess entities as “aligned” or “aligning” using the implied temperature hike scores.

Figure 3: Classifying Aligned and Aligning Entities

Source: Shirai and Dang (2024a).

Classifying Activities Related to Decarbonization

The activities can be decomposed into (i) green or near-green activities; (ii) activities in hard-to-abate sectors that are making efforts or planning to reduce emissions; (iii) enabling activities that make it possible to increase green or near-green activities and support emissions reduction efforts in hard-to abate sectors; (iv) investment in CCUS facilities and CDR measures; and (v) the early retirement of coal power plants (Figure 4). For example, green activities may refer to increasing the renewable energy supply and producing electric vehicles, while their related enabling activities could include the production of equipment, batteries and storage, grids, precious metals, as well as the utilization of ICT. CCUS and CDR measures can be used additionally to reduce emissions arising from enabling activities and hard-to-abate sectors. Emissions-intensive enabling activities are expected to reduce emissions over time with the availability of low-emissions energy.

Figure 4: Classifying Activities to Promote the Whole-of-Economy

Source: Shirai and Dang (2024a).

Economic activities can also be classified using existing sectoral decarbonization approaches that contain certain thresholds, such as those developed by the Climate Bonds Initiative, or through the development of separate taxonomies. The most well-known taxonomy is the European Union (EU) Taxonomy, which provides a general framework for an EU-wide classification system for environmentally sustainable activities. Applying sectoral decarbonization approaches and developing taxonomies are not mutually exclusive.

Taxonomies are gaining global popularity as tools to enhance credibility and transparency for investors. Some taxonomies encompass both green activities and a broad range of transitional activities that do not meet the criteria for green classification. For example, taxonomies developed by the Association of Southeast Asian Nations (ASEAN) and several ASEAN member countries incorporate various transitional activities, using a traffic-light classification system and setting sunset requirements for these transition activities (ASEAN Taxonomy Board 2023). To avoid lock-in scenarios, these taxonomies have introduced sunset requirements and provisions for early coal retirement activities. It will be important to observe how these taxonomies are applied in practice, such as through their use in corporate disclosures or green and transition bond standards (Shirai and Dang 2024b). Some central banks, including those in Malaysia and Indonesia, have begun recommending that banks report their lending activities in alignment with their respective taxonomies.

Conclusion

To accelerate the reduction of GHG emissions and achieve a net-zero economy, it is crucial to scale up transition finance. While expanding financial support for environmentally green activities remains essential, more focus should be given to financing a whole-of-economy transition toward net zero, including hard-to-abate sectors. The main challenges lie in identifying credible decarbonization pathways and assessing “aligned” and “aligning” entities. Transition finance should also focus on supporting entities that are currently emissions-intensive and thus not fully aligned with the goals, but might be assessed as “aligning” entities based on transition plans, progress toward these goals, and technology and cost feasibility.

As many entities are taking diverse approaches to lower their emissions, entity-level assessments should comprise activity-level analysis to provide a detailed evaluation. Further research is needed to develop the frameworks of transition finance, particularly in the context of Asia where many economies depend on coal-fired electricity generation and hard-to-abate sectors.

References

ASEAN Taxonomy Board. 2023. ASEAN Taxonomy for Sustainable Finance Version 2. 9 June. https://www.theacmf.org/sustainable-finance/publications/asean-taxonomy-for-sustainable-finance-version-3

Climate Bonds Initiative (CBI). 2024. Climate Bonds Standard: Globally Recognised, Paris-Aligned Certification of Debt Instruments, Entities and Assets Using Robust, Science-Based Methodologies, Version 4.1. https://www.climatebonds.net/files/files/climate-bonds-standard-v4-1-202403.pdf

Glasgow Financial Alliance for Net Zero (GFANZ). 2023. Scaling Transition Finance and Real-economy Decarbonization: Supplement to the 2022 Net-zero Transition Plans Report. GFANZ Secretariat Technical Review Note, 1 December. https://assets.bbhub.io/company/sites/63/2023/11/Transition-Finance-and-Real-Economy-Decarbonization-December-2023.pdf

Science-Based Targets Initiative. 2023. SBTi Corporate Net-Zero Standard Criteria Version 1.1. April. https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf

Shirai, S. 2024. Transition Finance to Drive an Economy-Wide Transition for a Net Zero Future. Nomura Journal of Asian Capital Markets 9(5): 4–9. https://www.nomurafoundation.or.jp/en/wordpress/wp-content/uploads/2024/09/NJ_2024_P04-09_PERSPECTIVE.pdf?20240917

Shirai, S., and L. N. Dang. 2024a. Transition Finance and Results of the Survey on 10 Asian Financial Authorities’ Initiatives: Climate Finance Dialogue Progress Report. ADBI Policy Brief No. 2024-23 (October). ADBI. https://www.adb.org/publications/transition-finance-and-results-of-the-survey-on-10-asian-financial-authorities-initiatives-climate-finance-dialogue-progress-report

Shirai, S., and L. N. Dang. 2024b. Transition Finance and Taxonomy Under the Spotlight in Asia: Evidence from the Survey on Asian Financial Regulators. Asia Pathways, 1 November. ADBI. https://www.asiapathways-adbi.org/2024/11/transition-finance-and-taxonomy-under-the-spotlight-in-asia/

Comments are closed.