Corporate market power has increased in Asia during the past decade, which can compromise the effectiveness of monetary policy. Although the trajectory of corporate mark-up levels in Asia over that period has been somewhat more muted than the global average, it has risen sharply (De Loecker and Eeckhout 2018). Market power has been a long-standing concern for many policy makers and academic researchers as it greatly matters for economic welfare and resource allocation (e.g., De Loecker et al. [2020]).

A new ADBI paper by Renzhi and Beirne (2023) delves further into this issue using firm-level data over the period 2013–2021 for over 3,000 firms across 11 economies in Asia, namely Hong Kong, China; Japan; the Republic of Korea; Singapore; Taipei,China; the People’s Republic of China; India; Indonesia; Malaysia; the Philippines; and Viet Nam. The paper finds strong empirical support that high market power, as measured by the distribution of firms’ mark-ups in the top quartile, weakens the effectiveness of monetary policy transmission.

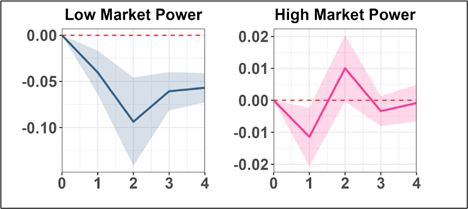

Firm mark-ups in Asia have been increasing since 2013, driven by advances in technology-based production and sectoral productivity. In an environment where firms face fewer competitive pressures in the setting of prices, the results indicate that these financial frictions are compounded by an impairment in the monetary policy transmission mechanism. A tightening in monetary policy has the expected dampening effect on firms’ real sales for firms that have low market power, i.e., firms that are in competitive markets with elastic demand for their products and services. For these firms, higher interest rates dampen real sales, thereby enabling the central bank to affect the business cycle. More specifically, a 1 percentage point rise in interest rates leads to a drop in real sales of around 0.09 percentage points after 2 years, with the negative effect dampening somewhat thereafter but exhibiting persistence and statistical significance over the time horizon. For firms with high market power, however, the effect of monetary policy is significant only for the first year at a magnitude much lower than firms with low market power (by a factor of around 5). Moreover, the response to the monetary policy shock becomes insignificant after the first year (see Figure 1).

Figure 1: Impulse Responses of Real Sales to Monetary Policy Shocks: High vs. Low Market Power Firms

Notes: The figure plots the impulse responses of real sales to a 1 percentage point contractionary monetary policy shock at an annual frequency. 95% confidence bands in shaded areas are reported. The vertical axis unit is percentage points, and the horizontal axis refers to the number of years.

Source: Renzhi and Beirne (2023).

It is evident, therefore, that where market power is high, the monetary policy transmission mechanism is disrupted. The results are robust to several robustness tests, including alternative monetary policy measures, alternative mark-up definitions, and concerns about additional factors that may affect the estimates. Renzhi and Beirne (2023) also find no material difference in the result for emerging versus advanced economies in Asia. In the case of the former, however, the elasticity of real sales is more pronounced and more persistent. This could be related to a higher natural rate of interest in emerging compared to advanced economies, and a greater scope for countercyclical monetary policy. Additionally, it is found that the heterogeneity in the degree of economic freedom, sectoral composition, and financial leverage does not eliminate the heterogeneous effects of monetary policy concerning firms’ market power.

Policy implications for central bankers and financial supervisors

Policy makers in central banks need to be aware that rising market power has made monetary policies less effective as dominant firms have fewer incentives to adjust their output when the cost of inputs changes, and they are also more immune to shifts in external financing conditions. It should also be noted that excessive growth in corporate market power could lead to higher inflation in economic downturns, with high-markup firms turning negative shocks into higher prices, thereby further impairing effective monetary policy transmission.

Maximizing the effective implementation of monetary policy would require a more level playing field as regards competition. Policy makers and competition authorities should closely monitor financial stability risks and negative economic repercussions related to the abuse of a dominant position through merger control. However, competition policy should be aimed at fostering an efficient market mechanism across all sectors of the economy and competitive price-setting behavior by firms. This would help to compress heterogeneity in market power dynamics and, therefore, enhance the effectiveness of monetary policy transmission. This needs to be balanced against the need for policies that continue to encourage innovation and productivity, underscoring the importance of policy coordination that also includes fiscal, industrial, and competition policies.

Click to read the working paper

References

De Loecker, J., and J. Eeckhout. 2018. Global Market Power (tech. rep.). National Bureau of Economic Research.

De Loecker, J., J. Eeckhout, and G. Unger. 2020. The Rise of Market Power and the Macroeconomic Implications. The Quarterly Journal of Economics 135(2): 561–644.

Renzhi, N., and J. Beirne. 2023. Corporate Market Power and Monetary Policy Transmission in Asia. ADBI Working Paper No. 1635. Tokyo: ADBI.

See also links

Corporate Market Power and Monetary Policy Transmission in Asia

Comments are closed.