Importance of financial literacy

Financial literacy has gained an important position in the policy agenda of many countries, and the importance of collecting informative, reliable data on the levels of financial literacy across adult populations has been widely recognized (OECD/INFE 2015a). At their summit in Los Cabos in 2012, G20 leaders endorsed the High-Level Principles on National Strategies for Financial Education developed by the Organisation for Economic Co-operation and Development International Network on Financial Education (OECD/INFE), thereby acknowledging the importance of coordinated policy approaches to financial education (G20 2012). At the same time, surveys consistently show that levels of financial literacy are relatively low, even in advanced economies (OECD/INFE 2016). The increasing need for individuals to manage their own retirement savings and pensions, resulting mainly from the trend of switching to defined-contribution pension plans from defined-benefit ones, indicates that the need for high levels of financial literacy is increasing.

The OECD/INFE has developed a standard survey instrument for gathering information on financial literacy and financial inclusion, the latest version of which is described in OECD/INFE (2015b). The OECD/INFE (2016) provides a summary of the results of these surveys for 30 economies but includes only four Asian economies—Hong Kong, China; the Republic of Korea; Malaysia; and Thailand—most of which have relatively high incomes. Our recent study of adult financial literacy in Cambodia and Viet Nam (Morgan and Trinh 2017) breaks new ground by examining countries with considerably lower levels of per capita income than the 30 economies covered by the OECD/INFE (2016). It also provides important evidence on the relationship between financial literacy and savings.

Concepts of financial literacy in the survey

The survey divides questions on financial literacy into three related aspects: financial knowledge, financial behavior, and attitudes to longer-term financial planning. Financial knowledge helps individuals to compare financial products and services and make appropriate, well-informed financial decisions. A basic knowledge of financial concepts and the ability to apply numeracy skills in a financial context ensure that consumers can manage their financial affairs independently and respond appropriately to news and events that may have implications for their financial well-being.

Financial behavior (or financial “savvy”) means taking (or not taking) financial actions. Some types of behavior, such as putting off bill payments, failing to plan future expenditures, or choosing financial products without shopping around, may have an adverse effect on an individual’s financial situation and well-being. Financial behavior may thus differ from financial literacy, and it is important to identify their relationship.

Attitudes regarding longer-term financial planning include aspects such as individuals’ time preferences and willingness to make planned savings. For example, one question asks about preferences for the short term through “living for today” and spending money. Such preferences are likely to hinder behavior that could lead to improved financial resilience and well-being.

Survey results

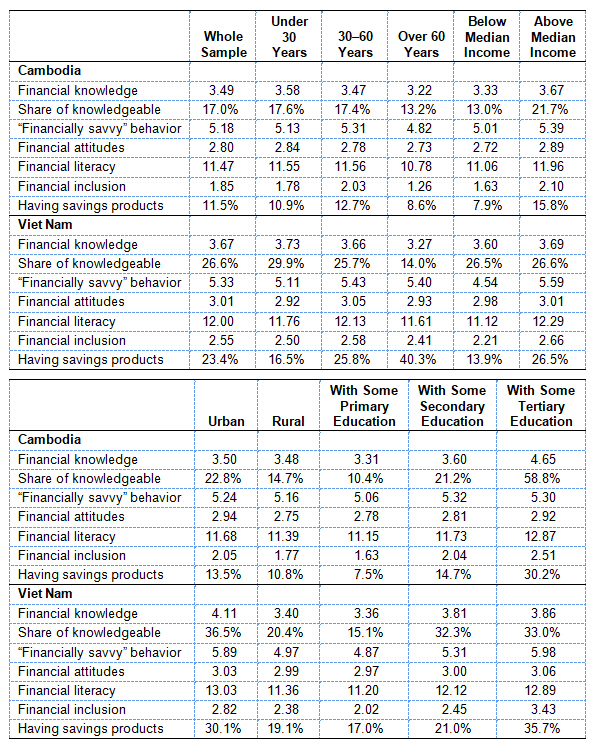

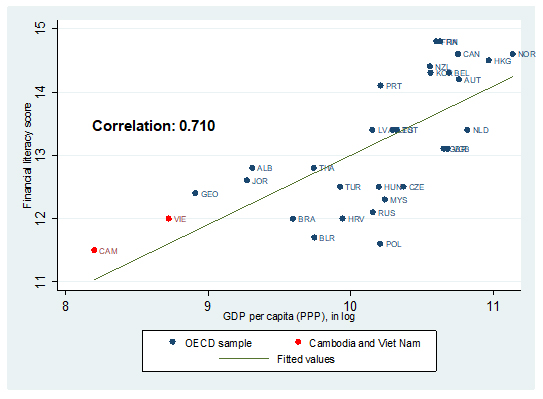

Table 1 presents the average values of the scores for financial literacy and financial inclusion in Cambodia and Viet Nam, including breakdowns by various categories. Both countries have rather low levels of financial literacy, with that of Cambodia being the lower of the two. The financial literacy scores are only 11.5 and 12.0 in Cambodia and Viet Nam, respectively, out of a total possible score of 21. These scores are much lower than the 30-economy average score of 13.3 and those of some other developing Asian economies, such as Thailand (12.8) and Malaysia (12.3) (Figure 1). However, these results may be taken as positive, given that the levels of per capita income in the two countries are considerably lower than those in any of the other 30 economies in OECD/INFE (2016). Figure 1 shows a fairly high correlation between average financial literacy scores and per capita gross domestic product (GDP), although there is still wide variation relative to the trend line. Both Cambodia and Viet Nam’s scores lie somewhat above the trend line.

Table 1: Financial Literacy and Financial Inclusion Scores in Cambodia and Viet Nam

Note: “Knowledgeable” refers to those answering at least five out of seven questions on financial knowledge correctly. A weighted sample is used to calculate the scores.

Source: Authors’ compilation from survey data.

Figure 1: Financial Literacy vs. GDP per Capita

PPP = purchasing power parity.

Source: OECD/INFE (2016), World Bank World Development Indicator database (http://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD), authors’ estimates.

Determinants of financial literacy

We conducted econometric analysis to investigate the determinants of the financial literacy scores. The results indicate that in both Cambodia and Viet Nam, people with higher education have higher scores for financial literacy. This corroborates the results of many other studies, including Bucher-Koenen and Lusardi (2011), OECD/INFE (2016), and Murendo and Mutsonziwa (2017). Higher income is also associated with a higher financial literacy score. This relationship holds even when we control for some indicators that determine individual income, such as education and occupation. However, the results by age group are mixed and are not significant for Viet Nam, although the 30–60 year age group shows a significantly higher level of financial literacy in Cambodia.

Impact of financial literacy on savings

We also investigated the effect of financial literacy on savings behavior, including both informal and formal savings. Ordinary least squares (OLS) estimates may be biased due to reverse causality (i.e., those with higher savings could improve their financial literacy), omitted variable bias, or measurement error in financial literacy. In order to address these endogeneity problems, following Fernandes, Lynch, and Netemeyer (2014) and Murendo and Mutsonziwa (2017), we used the mean financial literacy score at the provincial level as an instrumental variable for individual financial literacy.

The results show a positive and significant impact of financial literacy on savings in both Cambodia and Viet Nam. A one-standard-deviation increase in financial literacy increases the likelihood of having a formal saving product by 16 percentage points in Cambodia and by 7 percentage points in Viet Nam. This suggests that improvements in financial literacy could have a significant impact on aggregate savings in these two countries.

Conclusions

Perhaps the most robust finding is that higher levels of education were generally found to be highly significantly and positively correlated with financial literacy in both Cambodia and Viet Nam. Income was also positively correlated with higher financial literacy, although the evidence on age was less clear.

More importantly from a macroeconomic perspective, both financial literacy and general education levels were found to be positively and significantly related to formal and informal savings activity. Thus, improving general education levels is important, but additional gains can be obtained by developing policies such as financial education programs that directly affect financial literacy. These could have important potential impacts in terms of increasing savings in those countries.

_____

References:

Bucher-Koenen, T.A.B.E.A, and A. Lusardi. 2011. Financial Literacy and Retirement Planning in Germany. Journal of Pension Economics & Finance 10(4): 565.

Fernandes, D., J. Lynch, and R. Netemeyer. 2014. The Effect of Financial Literacy and Financial Education on Downstream Financial Behaviors. Management Science 60(8): 1861–1883.

Group of Twenty (G20). 2012. G20 Leaders Declaration. June 19. Los Cabos, Mexico. (accessed 1 December 2016)

Morgan, P. J., and L. Q. Trinh. 2017. Determinants and Impacts of Financial Literacy in Cambodia and Viet Nam. ADBI Working Paper No. 754. Tokyo: Asian Development Bank Institute.

Murendo, C., and K. Mutsonziwa. 2017. Financial Literacy and Savings Decisions by Adult Financial Consumers in Zimbabwe. International Journal of Consumer Studies 41(1): 95–103.

OECD/INFE. 2015a. Policy Handbook on National Strategies for Financial Education. Paris: OECD. (accessed 15 December 2016)

———. 2015b. 2015 OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion. Paris: OECD.

———. 2016. OECD/INFE International Survey of Adult Financial Literacy Competencies. Paris: OECD.

Comments are closed.