Small and medium-sized enterprise (SME) exporters have the potential to change the world. They are innovative, they are often young, and they are competitive. Yet globally, they can expect more than half (52%) of their proposals to finance trade transactions to be rejected by banks.

There are a variety of reasons for this high rejection rate, but one stands out: a global trade finance sector that is pulling away from perceived high-risk market segments. For Asia and the Pacific, which constitutes the highest proportion of global trade finance rejections, this means that the cost of trade will increase.

To understand how this will impact SME exporters, the Asian Development Bank’s (ADB) annual Trade Finance Gaps, Growth and Jobs survey asks firms to detail their experiences with trade finance. There are three features of how trade finance is used by SMEs that highlight the critical importance of trade finance in the broader access to finance discussion.

SMEs in Asia and the Pacific rely on expensive instruments

International trade is risky. Trade finance is used to manage this risk. This relationship is why emerging economies and exporters that are new to markets are particularly dependent on trade finance.

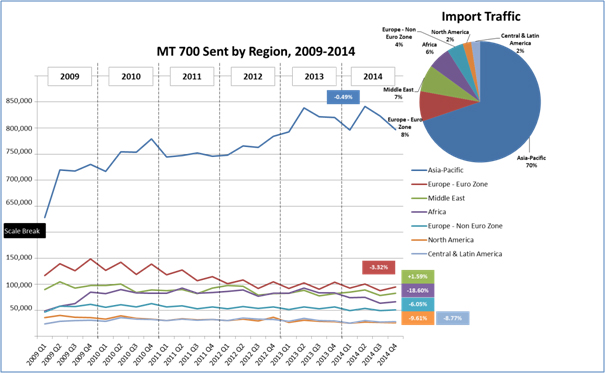

Firms in Asia and the Pacific are highly dependent on letters of credit (L/Cs), with 76% of all L/Cs originating in the region (Figure 1). This is because they are one of the most secure instruments, popular in a region where subregional and country risk is often high. A recent paper on L/C usage by traders in the United States (US) points out that Asia and the Pacific receives 11% of US exports, but requires 20% of its trade finance share.

The regional reliance on L/Cs impacts SMEs in two ways. First, as the highest-risk client segment in any country, SMEs will continue to be dependent on this instrument. Second, access is unlikely to expand without intervention as banks report rising regulatory costs related to certifying new clients and correspondent banks. Further, 93% of banks expect regulatory requirements to increase.

Certain markets in Asia are moving ahead into diversified trade finance instruments for SMEs—the People’s Republic of China is the major driver of factoring growth and digital finance in the region, for example—but L/Cs remain predominant.

Figure 1: Asia and the Pacific dominate MT700 messages

Note: MT700 is a type of message sent through the SWIFT communications platform associated with letters of credit.

Source: SWIFT 2014 trade traffic data (latest available).

SMEs don’t have many alternative options

When a proposal for trade finance is rejected, a firm has two choices: find an alternative or drop the transaction. Finding an alternative is more difficult for SMEs in Asia and the Pacific for several reasons.

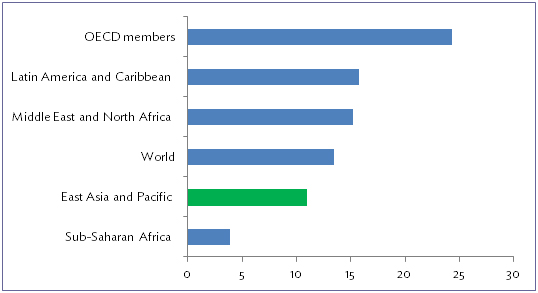

First, bank density in Asia and the Pacific is below the world average. Among developing country regions, only sub-Saharan Africa has a lower density (Figure 2). This means regionwide, there are fewer alternatives when a transaction is rejected. This scarcity is multiplied for SMEs, which in general do not have diversified banking relationships. This was reflected in the survey when only 55% of firms reported re-submitting a proposal when it was rejected.

Second, SMEs have few internal resources to draw on when a proposal is rejected. Of the SMEs that sought alternatives for a rejected transaction, 28% report being self-rationed (that is, an alternative is found, but it is too costly) and 19% report using an informal provider.

This suggests that SMEs will resort to inefficient second-best options when transactions are seen as important.

Figure 2: Bank density by region (banks per 100,000 people)

OECD = Organisation for Economic Co-operation and Development.

Source: World Bank World Development Indicators, 2014 (latest available year).

Trade finance enables better capital allocation

SMEs’ use of second-best options such as informal finance and self-financing tie up valuable capital during the export process. By comparison, when multinationals are faced with trade finance scarcity, they are better able to internally redistribute capital.

We do not have evidence about how capital is allocated in individual SMEs, but the answers to a question about how additional trade finance would be allocated are suggestive. A total of 13% of SMEs report that a hypothetical doubling of trade finance would lead them to increase investment in new businesses. This implies that trade finance shortfalls are met by pulling capital from other productive uses, and freeing up trade finance constraints will have positive spillovers beyond the trade transaction.

What about digital finance?

The rise of digital trade finance has exciting potential. New providers have entered the trade finance space—digital finance in particular is moving quickly. Several large online platforms are offering working capital for pre-export finance to certain categories of sellers. Crowdfunding and peer-to-peer lending can provide capital to new ventures.

As of today, activities are largely in the working capital space. Digital solutions have yet to become widely applied and traditional problems associated with providing financial support to SMEs in trade persist. For SME exporters in Asia, this means a continuation of the existing constrained environment. As new providers move into emerging markets, however, this may change quickly.

If only the world were as simple as you describe it. Digital finance is not a solution if the process of trade finance is not clearly understood and profound knowledge is not applied to the solution from inception. The current bank heists involving SWIFT are sufficient evidence of the widespread ignorance involving SWIFT, funds transfer and cybercrime.

Secondly, as Jeff Immelt of GE has expressed, everywhere, everyone avows that SMEs should be more involved in global trade, while killing them with regulation. This stupidity is the crowning achievement of the current US congress which has yet to fully authorize the US Ex-Im Bank. Finally, what I call the demarche of national monopoly toward global oligopoly continues (Baer and Monsanto for example) and it tramples small business in the process.