This year is shaping up to be another challenging year for bond markets in Asia after a see-saw 2013 which saw prices rise at the start of the year, and then fall back on news that the US Federal Reserve plans to reduce or “taper”its quantitative easing operations.

There are several key developments/trends which could have strong implications for the region’s bond markets this year. Here’s what to look out for:

1. Unwinding after the tapering

The US Federal Reserve announced it will cut its purchases of securities from $85 billion a month to $75 billion, starting January 2014. So far, the announcement has had little impact in Asia with bond prices relatively unchanged. Going forward, however, it will likely result in tighter liquidity in the region, putting upward pressure on bond yields. It should be noted at this point that the Federal Reserve has said the process will be gradual and dependent on the health of the US economy. Nevertheless, recent data indicates US economic growth remains strong and this could mean acceleration in the pace of the tapering, or even an unwinding of the Federal Reserve’s huge stash of bond holdings. When the Federal Reserve starts to unwind its position it could have strong repercussions on bond markets in the region.

2. Yuan internationalization

While most of the region’s currencies depreciated in 2013, the People’s Republic of China (PRC) yuan gained nearly 3% against the dollar, reaching new highs. This has boosted confidence in the currency and will encourage the PRC’s ambition to internationalize its currency.

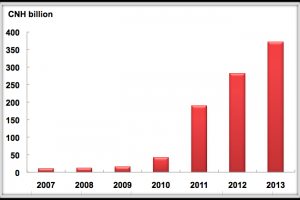

Interest in the currency is growing, reflected in the rising issuance of offshore yuan bonds (dim sum bonds). While Hong Kong, China is expected to remain a major offshore yuan hub, the role of other offshore yuan centers, such as those in Singapore and London, are expected to increase. Progressive steps have also been taken by PRC to liberalize its capital account, including the announcement of the planned creation of a Shanghai Free Trade Zone, which aims to eventually allow for free yuan convertibility.

3. Local government bond issuance in PRC

Figure: Growth in Dim Sum Bond Issuance. Source: Bloomberg

An official audit recently released showed that local government debt ―much of it to finance infrastructure― surged almost 70% between end-2010 and end-June 2013, with 40% expected to mature this year. Local governments are unlikely to be able to repay this debt as the infrastructure projects have yet to start paying for themselves. The National Development and Reform Commission has suggested allowing them to issue bonds to refinance existing borrowings from financial institutions to complete the infrastructure projects. This will help develop bond markets further and improve the stability of the banking system by diversifying the risk of infrastructure projects among a larger group of investors. As urban infrastructure financing needs across the region remain large, we could see other regional and municipal governments issuing bonds to finance their investments. However, for that to happen, the proper regulatory framework and fiscal management system have to be put in place.

4. Tighter liquidity and rising inflation

Inflationary pressures have started picking up in several countries in the region, and the general tightening of global liquidity from tapering is expected to put upward pressure on interest rates. This is notwithstanding the likely continued expansionary stance of European Central Bank and Bank of Japan. Some countries are also looking to stem the rise of credit to head off possible asset bubbles. The People’s Bank of China, for one, has taken measures to tighten liquidity to dampen credit growth, mostly through the use of reverse repos. Indonesia also raised its policy rates by 175 basis points in 2013 to stave off inflationary pressures. These trends suggest that bond yields will probably go up in 2014, but the amount will vary from country to country.

5. Shift towards foreign currency debt issuance

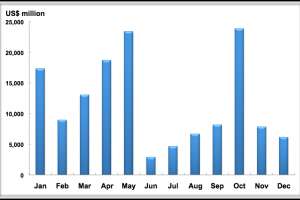

Figure: Foreign Currency Bond Issuance in Emerging East Asia. Source: Bloomberg LP

As domestic credit conditions tighten in some countries there may be a further shift towards more foreign currency debt issuance. After the tapering announcement in 2013, foreign currency bond issuances dropped off but recently started picking up again with a $4 billion issue by Indonesia in January 2014. While US interest rates have risen, they still remain broadly low and some foreign currency debt issuers see this as an opportunity to lock in the current rates before they rise further. Of course, borrowing in a foreign currency exposes them to exchange rate risks but given that many regional currencies have depreciated significantly, the expectations are that these currencies are already at their low points.

This article was first published by the ADB Development Blog.

Comments are closed.