Japanese Prime Minister Shinzo Abe’s economics platform, dubbed Abenomics, is a policy package consisting of three “arrows”: aggressive monetary easing with inflation targeting; flexible fiscal policy; and growth strategy. Together, the three arrows aim to lift Japan’s economy out of chronic deflation and stagnation, putting it on a path of sustainable growth. Thanks to the first and second arrows, Japan’s economy is firmly on the pathway to recovery and ready for the third arrow, barring political will. Tokyo’s recent successful bid to host the 2020 Olympic Games complements the Abenomics strategy by presenting a not-to-be-missed opportunity to solve Japan’s debt sustainability problem.

Early success of first arrow

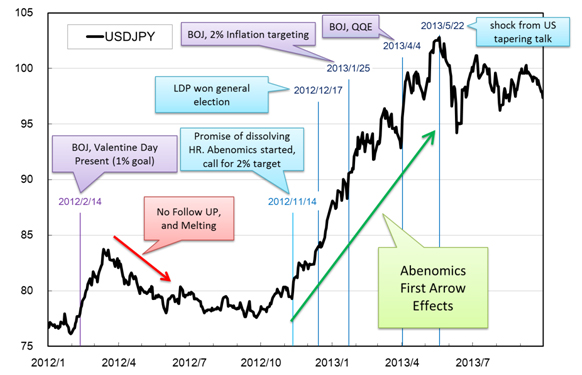

Abenomics’ first arrow—aggressive monetary easing with inflation targeting—has been on target and working remarkably well. It started to have a positive impact on the Japanese economy well before the Bank of Japan announced bold “qualitative and quantitative easing” in April 2013 as a means to achieve its inflation target of 2% (Figure 1). It was striking that persistent talk of these policies changed investor expectations even without currency market intervention. Between November 2012 and spring 2013, the yen depreciated by 20% against the US dollar and stock prices rose by 50%. The resultant wealth effect from higher stock prices boosted consumption for the first and second quarters of 2013. Today, the yen/US dollar exchange rate remains at around 100 yen, a comfortable level for Japan’s exporters.

Figure 1: Yen/US Dollar Exchange Rates, January 2012 to October 2013 (Yen)

Note: Graph created by the author

Source: Daily closing prices, published by Nikkei

Fiscal policy challenge: Second arrow

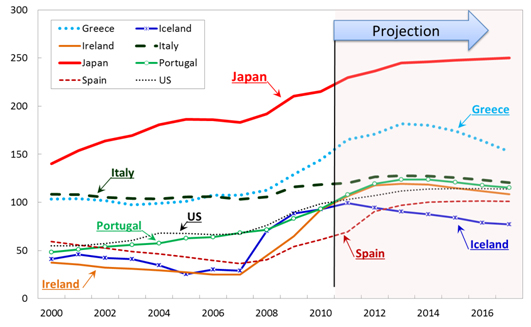

The second arrow, flexible fiscal policy, although also on target, has been more challenging. It would have been designed as a quick fix to lift the economy out of deflation, if not for Japan’s deteriorating sovereign debt situation (Figure 2). Japan’s gross public debt is over 200% of the country’s gross domestic product and its fiscal deficits have been approaching an alarming 50% of government budget. With the Japanese government already one of the leanest amongst developed economies, the country would have to rely mainly on tax increases to ensure fiscal sustainability in the medium term. The second arrow is challenging because it involves a temporary increase in government spending in order to achieve a permanent tax hike for fiscal consolidation. In the first and second quarters of 2013, Japan upped its fiscal expenditures. Together with the first arrow, the country’s economic growth rate was temporarily boosted to a brisk 4% in the second quarter of 2013. The faster growth rate made tax increases more acceptable to the Japanese public. In October 2013, Mr. Abe decided to go ahead with a consumption tax increase from 5% to 10% in two stages by 2015. To cushion the impact of the first stage 3% consumption tax increase in April 2014, Japan’s Cabinet approved an additional $53 billion in fiscal stimulus in December 2013.

Figure 2: General Government Gross Debt, 2000 to 2016 (% of GDP) Note: Graph created by the author

Source: International Monetary Fund, World Economic Outlook Database, October 2012.

Third arrow yet to be released

The third arrow, growth strategy, has yet to be released. It is designed to increase productivity in several key industries and is widely thought to be the most critical among the three arrows. Central to the growth strategy are long-needed regulatory reforms in agriculture, healthcare, education, energy, female workforce participation, and foreign workers. A comprehensive list of the good ideas to reform these areas has been documented in the Japan Revitalisation Strategy, published in June 2013. All that is required now is the political will to legislate and implement these good ideas. The Diet session, which started in October 2013, aims to realize the growth strategy. It remains to be seen whether this happens.

Tokyo 2020 Olympics an opportunity

Tokyo’s successful bid to host the Olympic Games in 2020 complements Abenomics by presenting a great opportunity for Japan to finally solve the country’s debt sustainability problem. A month before the 2000 Sydney Olympic Games, Australia increased its consumption tax from 0% to 10%. This enabled the country to raise tax revenue and offset the construction and tourist booms arising from hosting the games. Japan should do the same. Between 2015 and 2020, Japan could gradually increase its consumption tax from 10% to 20%. This would turn the Japanese government’s budget deficit into a surplus and begin the process of reducing its huge public debt. It would also help the country mitigate the investment boom before the 2020 Tokyo Olympic Games and prepare for the post-Olympics downturn.

The Olympic Games were last held in Tokyo in 1964. To finance massive infrastructure projects like the shinkansen (high-speed train system) and highways, Japan borrowed a large amount of funds from the World Bank. The accompanying construction boom before the Olympic Games crashed after the games, leading to a big recession in 1965. For the first time since WWII, the Japanese government issued bonds to finance fiscal spending in response to the downturn. Prior to that, Japan was the best student of the International Monetary Fund and adhered to a balanced government budget. Since the post-1964 Olympic Games recession, Japan’s public debt has skyrocketed. The 2020 Tokyo Olympics presents an opportunity to reverse this via raising the country’s consumption tax before the games commence.

Conclusion

Abenomics’ first and second arrows have put the Japanese economy firmly on the path to recovery. The country is now awaiting the release of the third arrow. The 2020 Tokyo Olympics complement the Abenomics strategy by presenting a golden opportunity to solve Japan’s debt sustainability problem. If the Japanese government is wise to increase consumption taxes before the 2020 Olympics, then the debt problem that started after the 1964 Olympic Games can be stopped in 2020.

_____

References:

Takatoshi Ito. 2013. ‘Abenomics’: Early Success & Prospects. Japan Spotlight. September/October.

Takatoshi Ito. 2013. Consumption Tax Fears Risk Stalling Abe’s ‘Three Arrows.’ East Asia Forum.

Comments are closed.