A scaling up of finance is urgently needed to accelerate decarbonization efforts and achieve net zero. There is growing agreement that financial initiatives should go beyond solely funding green activities. Transition finance, which aims to support an economywide shift toward net zero, has gained significant attention in recent years. Efforts to develop a taxonomy for both green and transitional activities in Asia have also emerged as part of further initiatives to promote transition finance. To evaluate current practices and plans, the Asian Development Bank Institute (ADBI) conducted a survey in August 2024, focusing on 10 Asian financial authorities as part of the ADBI–ADB Asian Climate Finance Dialogue (Shirai and Dang 2024).

Net-zero emissions targets

Transparency in climate-related corporate disclosures, such as greenhouse gas emissions reduction targets and timetables, science-based targets, and transition plans, is crucial for enhancing transition finance. The survey inquired whether financial authorities encourage or plan to encourage entities to set emissions reduction targets. The responses showed that all respondents had encouraged entities (such as companies) to set emissions reduction targets. On the types of targets, about 60% of the respondents selected “net zero emissions reduction targets and associated short- and medium-term objectives (aligned with a 1.5℃ pathway)”. Another 30% of total respondents chose the option “emissions reduction targets without specifying temperature pathways.” Only 10% selected the answer “short-, medium-, and long-term emissions reduction targets in line with a pathway well below 2℃”.

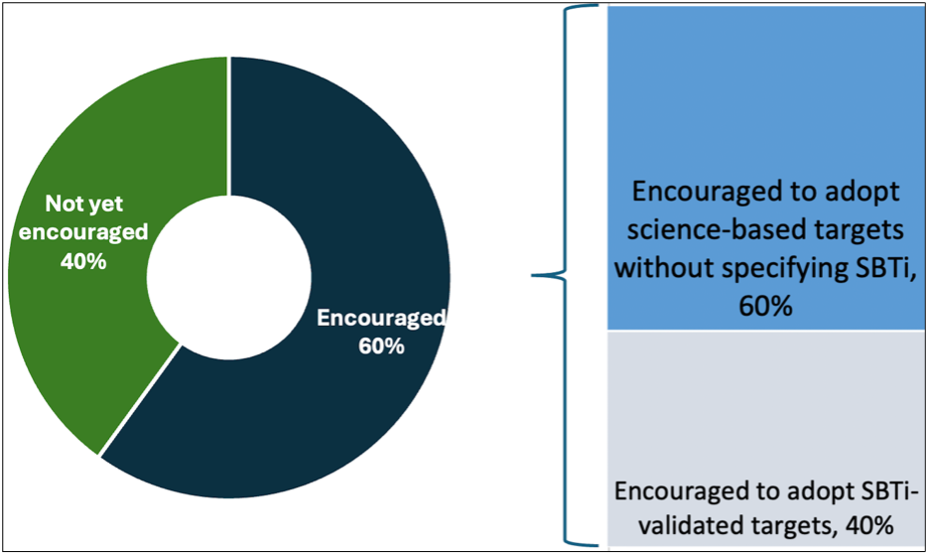

The sustainable finance community widely believes that it is essential to encourage entities to adopt science-based targets, such as those certified by the Science Based Targets Initiative (SBTi), and other methodologies, along with securing assurance on specific emissions reduction targets and metrics (including greenhouse gas emissions) (SBTi 2023). The survey results indicate that 60% of the total respondents have promoted or intended to promote the adoption of science-based targets by entities, while 40% have not yet contemplated this action. Among the respondents that encouraged science-based targets, 60% chose science-based targets without specifying SBTi, while 40% answered that they had encouraged the SBTi-validated targets. Obtaining assurances on targets and metrics had been encouraged by 50% of the financial authorities (Figure 1).

Figure 1: Encouraging Science-Based Targets (Multiple Options)

Source: Prepared by the authors.

Transition plans as tools for demonstrating commitment

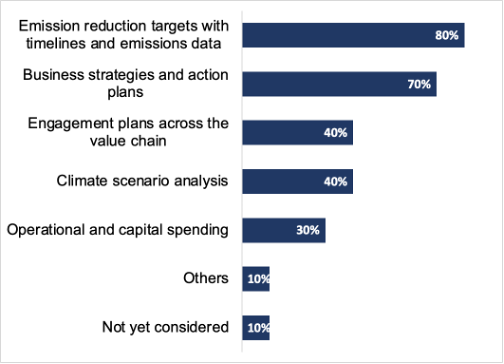

Global investors believe that credible transition plans should encompass a comprehensive vision and strategy for attaining long-term emissions reduction objectives. Investors concentrate on the strategic initiatives that entities take, such as generating low-carbon products and services, collaborating with key suppliers, devising financial strategies, and executing organizational reforms to further those objectives. Besides emissions reduction targets and data, the survey results show that 70% of respondents considered it essential to have a detailed description of business strategies and action plans. Climate scenario analysis and engagement plans were the next most important elements (Figure 2). In a separate question, many financial authorities also pointed out that incentives for issuers or investors will be necessary to further promote transition finance.

Figure 2: Information Needed to Promote Credible Transition Plans (Multiple Options)

Source: Prepared by the authors.

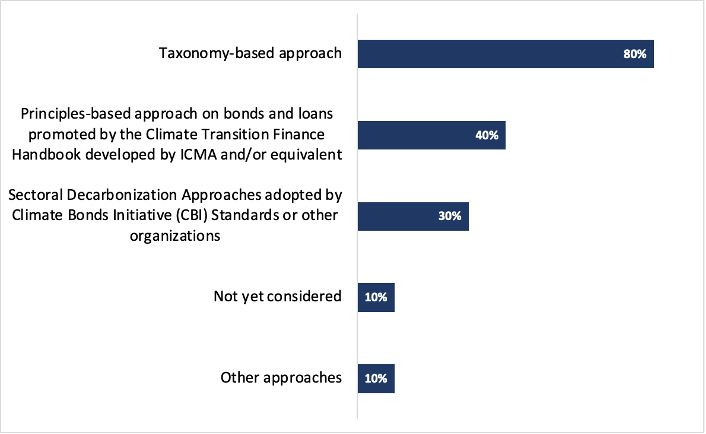

Growing emphasis on a taxonomy-based approach

With regard to specific measures to promote transition finance, a growing number of economies around the world have been developing taxonomies. In addition, many governments, companies, and financial institutions issue green and other labeled bonds. These labeled bonds are issued with second-party opinions certifying that issuers’ disclosure and objectives adhere to specific guidelines and standards established by organizations such as the International Capital Market Association (ICMA) and the Climate Bonds Initiative (CBI) (ICMA 2023; CBI 2024). The survey results found that the taxonomy approach was most commonly used by the financial authorities (80% of respondents). The second most popular approach was the principles-based approach developed by the ICMA and/or equivalents (40% of the respondents). This was followed by sectoral decarbonization approaches promoted by CBI standards or other organizations, accounting for 30% (Figure 3).

Figure 3: Approaches to Enhance Transition Finance (Multiple Options)

Source: Prepared by the authors.

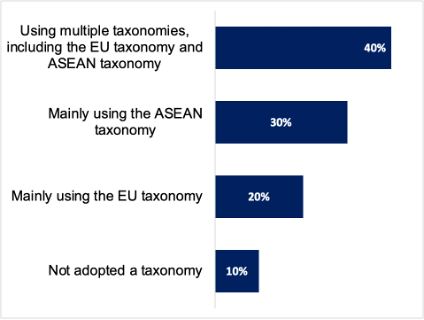

For the taxonomy-based approach, 90% of the respondents had already implemented or intended to create a national taxonomy. Among them, most had already been developing or planning to develop taxonomies for transitional activities. The survey results found that about 40% of the total respondents chose to refer to taxonomies including the EU Taxonomy for Sustainable Finance and ASEAN Taxonomy. About 30% of the respondents primarily used the ASEAN Taxonomy (ASEAN Taxonomy Board 2023), and 20% used the EU Taxonomy as a point of reference (Figure 4).

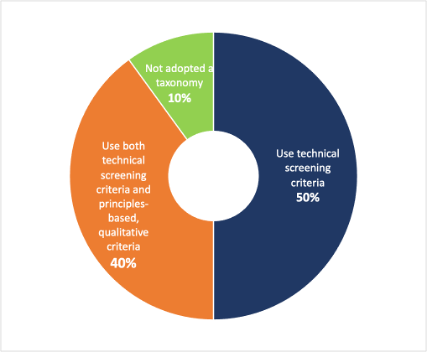

A taxonomy can be developed using technical screening criteria (TSC), as demonstrated by the EU Taxonomy, or by adopting a qualitative, principles-based approach. The survey results showed that half of the financial authorities were using or planned to use TSC, while 40% used or intended to use both TSC and a principles-based approach (Figure 5). To mitigate greenwashing concerns over transitional activities, about 60% of the total respondents had already adopted or planned to adopt a sunset clause with a fixed timeline guided by the authority.

Source: Prepared by the authors.

Source: Prepared by the authors.

Conclusion

Overall, it is encouraging to find that many financial authorities are undertaking measures to attract global investors and thus increase transition finance to accelerate an entire-economy transition to net zero. However, there is still significant variation in the progress toward adopting measures and approaches in Asia. These range from the utilization of incentive mechanisms to detailed transition plans including net-zero targets and science-based targets, national taxonomy deployment, technical screening criteria and/or a principles-based approach, and the adoption of a sunset clause.

Transition finance necessitates a multifaceted ecosystem for facilitation. Thus, continued and further actions are needed to advance robust frameworks for financing the transition, especially in Asia, where numerous economies rely on coal-fired electricity generation and hard-to-abate sectors. A strong level of collaboration between governments, regulators, and industry stakeholders to establish standardized taxonomies on transitional activities, mandate climate-related corporate disclosure requirements, draft credible transition plans, and create an enabling environment for labeled bonds and other dedicated financial vehicles’ transactions will pave the way for accelerating transition finance at pace and scale across Asian economies. Organizations such as ADBI can continue to actively support Asia to scale up transition finance and accelerate the whole-economy transition to net zero.

References

ASEAN Taxonomy Board. 2023. ASEAN Taxonomy for Sustainable Finance Version 2. 9 June. https://asean.org/wp-content/uploads/2023/03/ASEAN-Taxonomy-Version-2.pdf

Climate Bonds Initiative (CBI). 2024. Climate Bonds Standard: Globally Recognised, Paris-Aligned Certification of Debt Instruments, Entities and Assets Using Robust, Science-Based Methodologies, Updated February 2024, Version 4.1. https://www.climatebonds.net/files/files/climate-bonds-standard-v4-1-202403.pdf

International Capital Market Association (ICMA). 2023. Climate Transition Finance Handbook Guidance for Issuers. June. https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/climate-transition-financehandbook/

Science-Based Targets Initiative (SBTi). 2023. SBTi Corporate Net-Zero Standard Criteria Version 1.1. April. https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf

Shirai, S., and L. N. Dang. 2024. Transition Finance and Results of the Survey on 10 Asian Financial Authorities’ Initiatives: Climate Finance Dialogue Progress Report. ADBI Policy Brief No. 2024-23 (October). https://www.adb.org/publications/transition-finance-and-results-of-the-survey-on-10-asian-financial-authorities-initiatives-climate-finance-dialogue-progress-report

Comments are closed.