Blended finance is an international public–private funding mechanism aimed at mobilizing private funds for infrastructure investment in emerging and developing economies (EMDEs). However, expanding the scale of blended finance in clean energy will require innovative efforts from the international community to reform traditional development finance approaches.

Blended finance is an international public–private funding mechanism aimed at mobilizing private funds for infrastructure investment in emerging and developing economies (EMDEs). However, expanding the scale of blended finance in clean energy will require innovative efforts from the international community to reform traditional development finance approaches.

Asia faces huge clean energy investment gaps

The effective implementation of global greenhouse gas (GHG) emissions reductions requires special attention on Asia. The People’s Republic of China (PRC), India, and Southeast Asia together are estimated to account for around 70% of the world’s increase in electricity demand during 2023–2025 (IEA 2023). Asia also heavily relies on coal-fired power generation, with the average operating life of a coal fuel power plant being only 14 years—much shorter than the 45-year average in the United States (US) and Europe. Thus, those plants in Asia must be replaced with clean energy plants before the costs can be fully recovered.

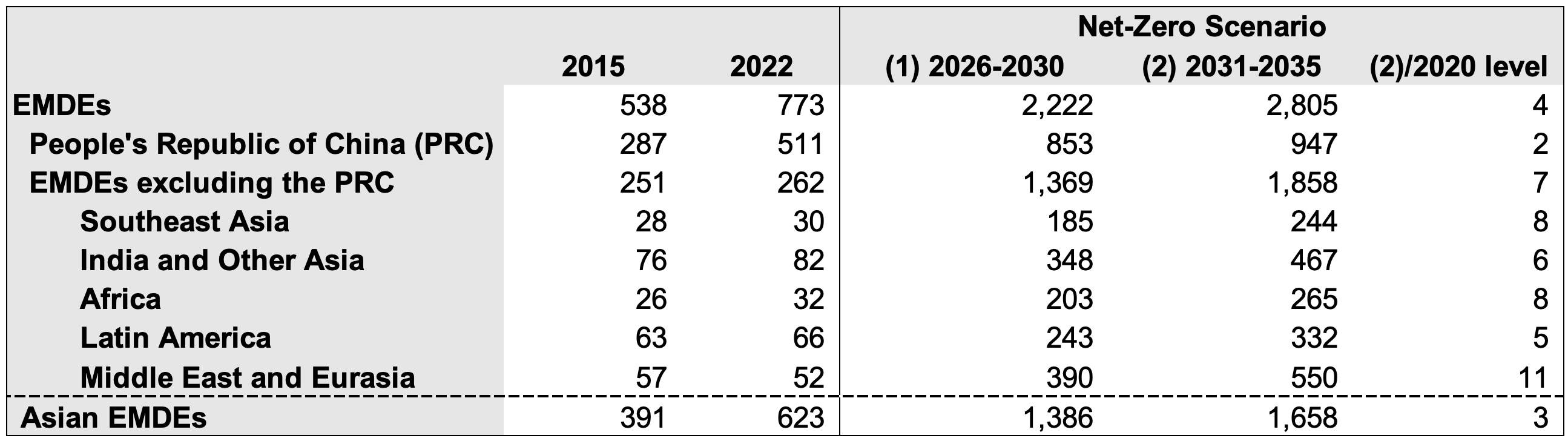

Many Asian countries have pledged net-zero GHG emissions. To make this a reality, annual clean energy investments need to increase from $62.3 billion in 2022 to $138.6 billion in 2026–2030 and $165.8 billion in 2031–2035 (IEA 2023). Table 1 shows that the PRC currently accounts for approximately 80% of the total investment in Asia. As other Asian countries need to increase clean investment over time, the PRC’s share will drop to 62% in 2026–2030 and 57% in 2031–2035. “Other Asia” will need 6–8 times more investment than the current level by 2031–2035. Even excluding the PRC, Asia’s investment will be largest in the EMDEs.

Table 1. Annual Clean Investment Required under the Net-Zero Scenario ($ billion)

Source: Prepared by the author based on IEA (2023).

Source: Prepared by the author based on IEA (2023).

Blended finance and credit ratings

EMDEs, excluding the PRC, represent nearly 70% of the world’s population, but their clean energy investment accounts for only 20% of the global total. This reflects the shortage of private capital due to political, economic, and exchange rate risks. Blended finance can be helpful for such countries by allocating more public funds initially and gradually reducing them as private capital increases with their track record and experience with projects (Shirai 2023). Public funds can reduce the risks borne by private investors through equity investment, loans, guarantees, grants, and technical assistance.

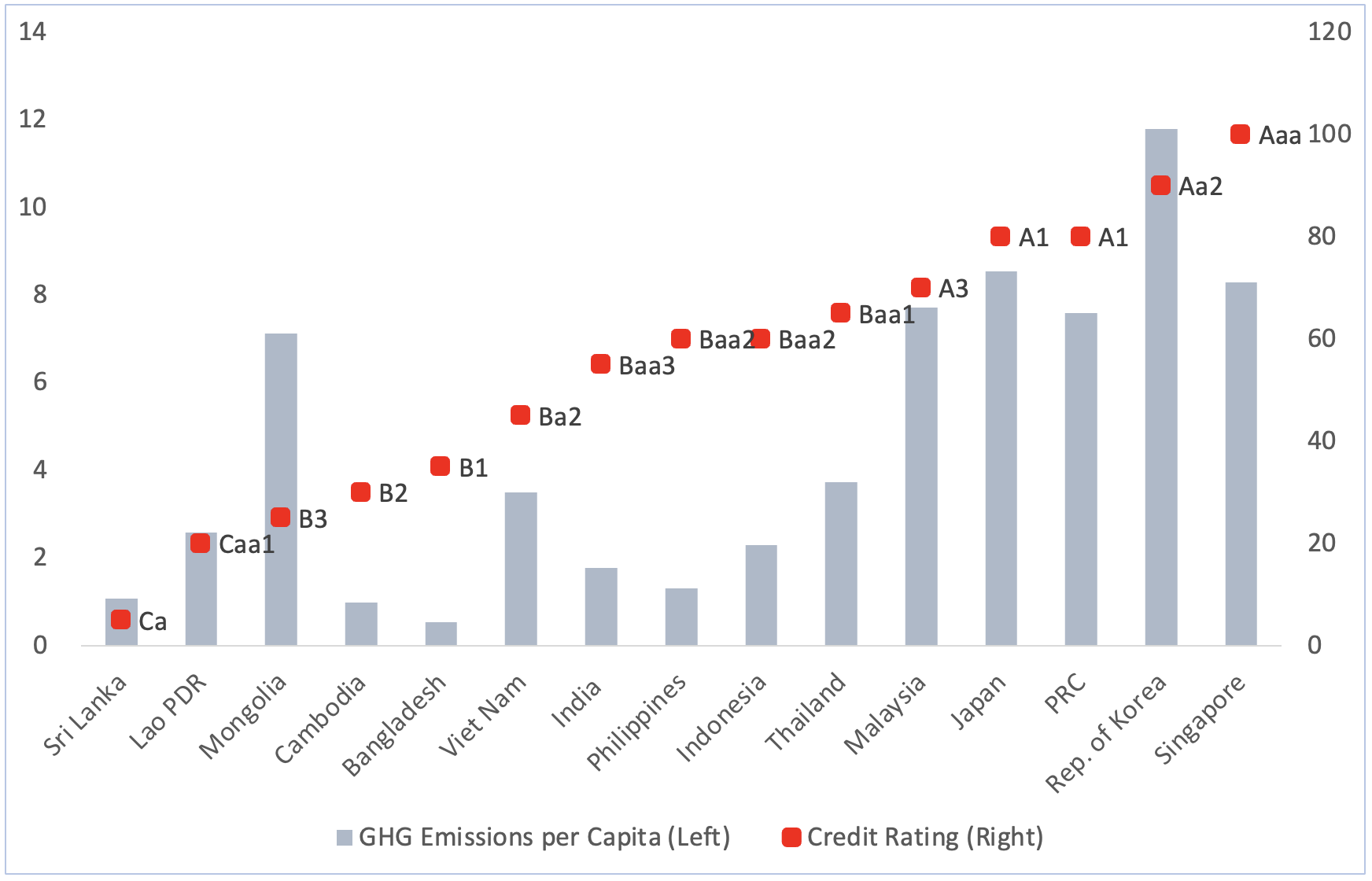

Figure 1 shows the sovereign bond ratings and per capita GHG emissions in Asia. Emissions-intensive countries with low credit ratings face challenges in attracting private capital and, thus, may need more public funds. Blended finance may not be suitable for low-income countries with high degrees of debt stress. In such countries, debt-for-climate swaps or grants based on climate performance could be explored (Shirai 2023).

Figure 1. Per Capita GHG Emissions (tons of CO2 equivalent) and Sovereign Credit Ratings

Note: The sovereign credit rating is adjusted to a numerical number ranging from 0 to 100.Source: Prepared by the author based on S&P Global and Our World in Data.

Note: The sovereign credit rating is adjusted to a numerical number ranging from 0 to 100.Source: Prepared by the author based on S&P Global and Our World in Data.

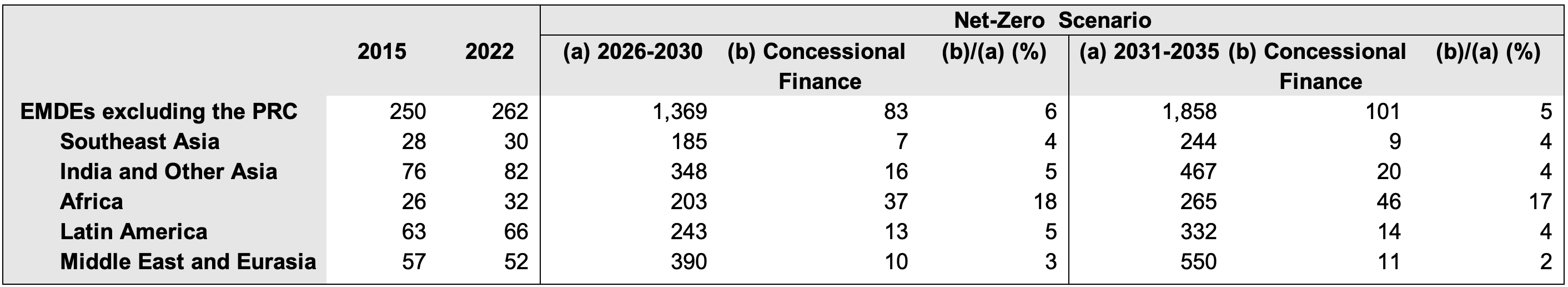

To achieve net zero in Asia, concessional funds would be needed to increase blended finance. It is estimated that such funds need to account for about 10%–20% of total investment in Asia (IEA 2023). In Africa, which is often perceived to carry higher risks compared to Asia, nearly half of the funds would need to be concessional (Table 2).

Table 2. Annual Clean Investment and Concessional Finance Required under the Net-Zero Scenario ($ billion)

Source: Prepared by the author based on IEA (2023).

Source: Prepared by the author based on IEA (2023).

Just Energy Transition Partnerships

Just Energy Transition Partnerships (JETPs), announced at COP 26 in 2021, are a collective financial mechanism to help EMDEs achieve their GHG reduction targets by replacing coal-fired power plants with clean energy supply. Advanced economies, such as the United Kingdom, Germany, Japan, France, the United States, and the European Union—and the Glasgow Financial Alliance for Net Zero Working Group—an alliance which includes Bank of America, Citi, Deutsche Bank, HSBC, MUFG, and Standard Chartered—have jointly pledged funds, and they are working together to mobilize funds from other public and private funds to meet the pledge. Agreements were concluded with South Africa in 2021 (total of $8.5 billion), Indonesia ($20 billion) and Viet Nam ($15.5 billion) in 2022, and Senegal (€2.5 billion) in 2023. The recipient countries are required to develop emission reduction plans, including paths toward the reduction of coal dependence and a smooth transition for impacted industries and workers.

These initiatives are welcome, but it remains uncertain whether the pledged amounts will be mobilized. As EMDEs are cautious about increasing external debt at market rates, more concessional loans, guarantees, and equity investments appear to be needed. An external review conducted in 2022, following the G20’s directive, suggested that multilateral development banks have room to enhance their lending capacity without losing their AAA credit ratings by adopting a more flexible approach to their capital (Boosting MDBs’ Investing Capacity 2022). In response, the International Bank for Reconstruction and Development (IBRD) of the World Bank will reduce its capital-to-loan ratio to mobilize additional lending capacity of around $4 billion.

Advanced economies should take more innovative actions. For example, the special drawing rights of the International Monetary Fund held by advanced countries could be recycled for an extended period to increase the leverage of regional development banks, such as the African Development Bank and the Asian Development Bank. In addition, advanced countries must reexamine their traditional development finance approaches and enable more funds for blended finance through guarantees or equity investments. It is time for G7 countries to take greater leadership in promoting carbon neutrality in the EMDEs.

References

Boosting MDBs’ Investing Capacity. 2022. An Independent Review of Multilateral Development Banks’ Capital Adequacy Frameworks. https://cdn.gihub.org/umbraco/media/5094/caf-review-report.pdf

International Energy Agency (IEA). 2023. Scaling up Private Finance for Clean Energy in Emerging and Developing Economies. International Energy Agency and International Finance Corporation. https://www.iea.org/reports/scaling-up-private-finance-for-clean-energy-in-emerging-and-developing-economies

Shirai, S. 2023. Global Climate Change Challenges, Innovative Finance, and Green Central Banking. Tokyo: ADBI. https://www.adb.org/publications/global-climate-challenges-innovative-finance-and-green-central-banking

Comments are closed.