Asia has made substantial progress on economic development over the past 3 decades, with the quality of institutions playing an important role. Real gross domestic product (GDP) per capita has grown by around 4% annually across the region on average from 1996 to 2022. Institutional quality components such as the control of corruption, law and order, political stability, and regulatory quality are key contributory factors, also for underpinning macroeconomic stability. Moreover, institutional quality comprises an important pull factor for international capital flows (Alfaro et al. 2007; Pagliari et al. 2017).

Countries with higher levels of institutional quality tend to have more liquid financial markets, with less vulnerability to sharp reversals of capital flows during crisis times, and they are able to attract global capital flows that are less short-term and less volatile in nature, such as foreign direct investment (FDI) and portfolio equity investment. In addition, high levels of institutional quality are associated with less external debt exposure, more export-oriented FDI policies, and more liberalized trade and capital accounts. While numerous studies exist on the benefits of enhanced institutional quality for economic growth, productivity, and economic development (e.g., Knack and Keefer [1995]; Mauro [1995]; Hall and Jones [1999]; Rodrik et al. [2004]), there is less work on the role of institutions as a buffer for economic and financial shocks.

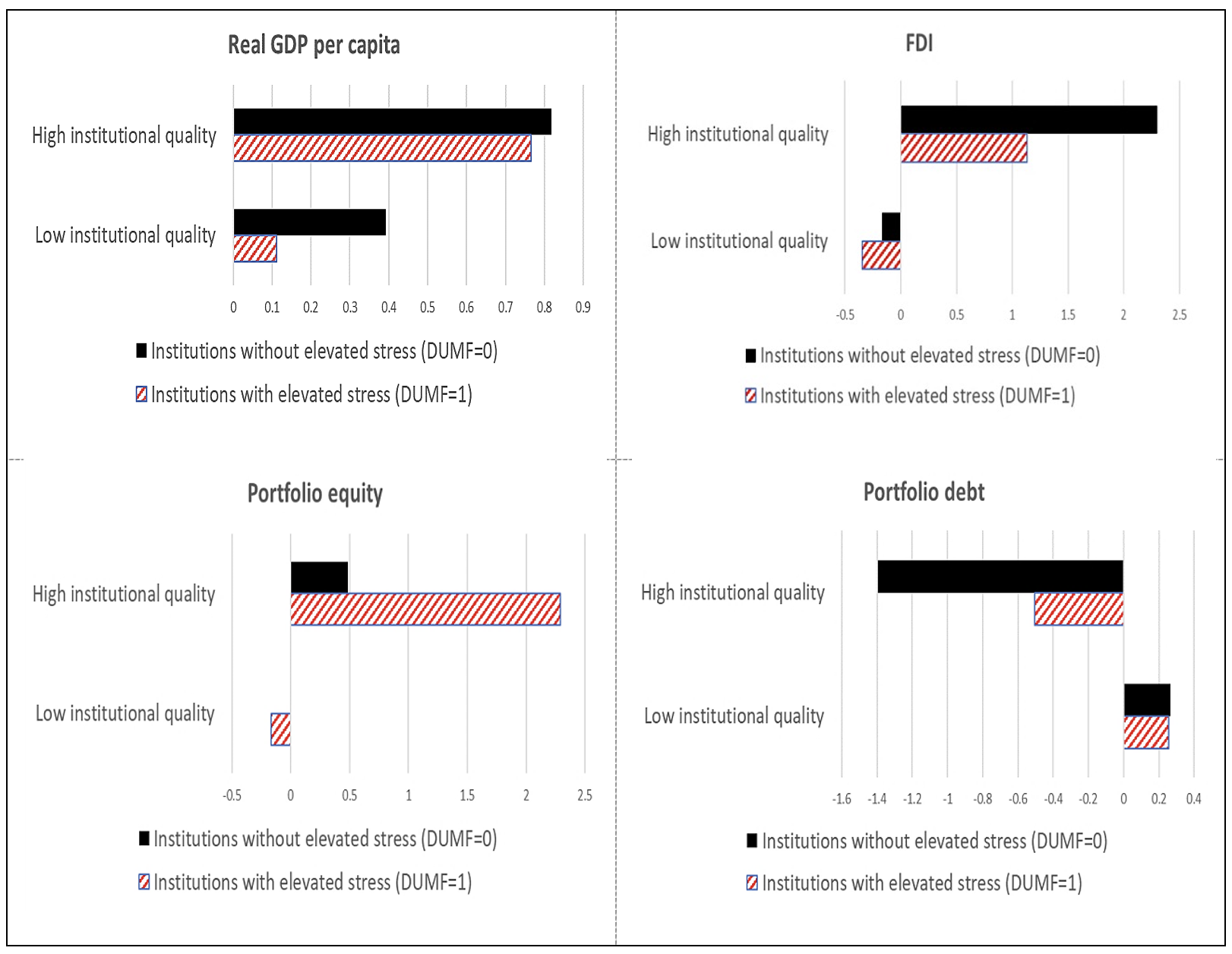

New ADBI research by Beirne and Panthi (2022) contributes to this literature in the context of Asian economies. Focusing on 12 Asian economies over the period 1996 to 2020, split between economies that have high and low levels of institutional quality, they empirically test the role of institutions as a resilience mechanism for real GDP per capita and international capital flows during episodes of elevated financial stress. The main findings from the paper are summarized in Figure 1.

Figure 1: Total Marginal Effects of Institutions on GDP per Capita and Capital Flows

FDI = net foreign direct investment, DUMF = dummy for Financial Stress Index, GDP = gross domestic product.

FDI = net foreign direct investment, DUMF = dummy for Financial Stress Index, GDP = gross domestic product.

Notes: The figure reports the total (significant) marginal effects from a panel regression analysis. Capital flow measures are net inflows as a share of GDP. The measure used for institutions is based on a principal component analysis of six components of institutions, namely control of corruption, government effectiveness, voice and accountability, political stability and absence of violence, the rule of law, and regulatory quality. High institutional quality reflects economies in the sample with institutional quality above the long-term historical average, while low institutional quality refers to economies below the average.

Source: Beirne and Panthi (2022).

For real GDP per capita, a threshold effect is evident, whereby the institutions of economies with high levels of institutional quality have twice the effect on economic development in normal times than those of economies with low levels of institutional development. In times of elevated financial stress, the marginal effect of economies with high institutional quality remains largely constant, whereas the effect declines substantially for economies with low institutional quality. This implies that institutions in the former group bolster the resilience of real GDP per capita to heightened financial tensions.

For capital flows, there is generally much more susceptibility to shifts in financial stress compared to GDP per capita. In the case of FDI, while elevated financial stress reduces the marginal effect of institutions in economies with high institutional quality by a factor of around 2, the overall effect remains positive and significant. For these economies, therefore, institutions have an important role to play in supporting the resilience of FDI. By contrast, the institutions of economies with lower levels of institutional development do not exhibit positive effects on FDI, even in normal times. Elevated financial stress reduces FDI net inflows for these economies.

On portfolio equity, there is some evidence to suggest portfolio rebalancing effects and safe-haven flows to economies with high institutional quality during crisis times. For these economies, while institutions positively affect equity even in normal times, the effect is magnified more than fourfold in crisis times. While supporting resilience, therefore, it also may suggest that investors rebalance their portfolios toward these economies in times of elevated financial stress. For economies with low-quality institutions, there is no effect of institutions on equity in normal times, whereas a reduction in net equity inflows is evident in crisis times.

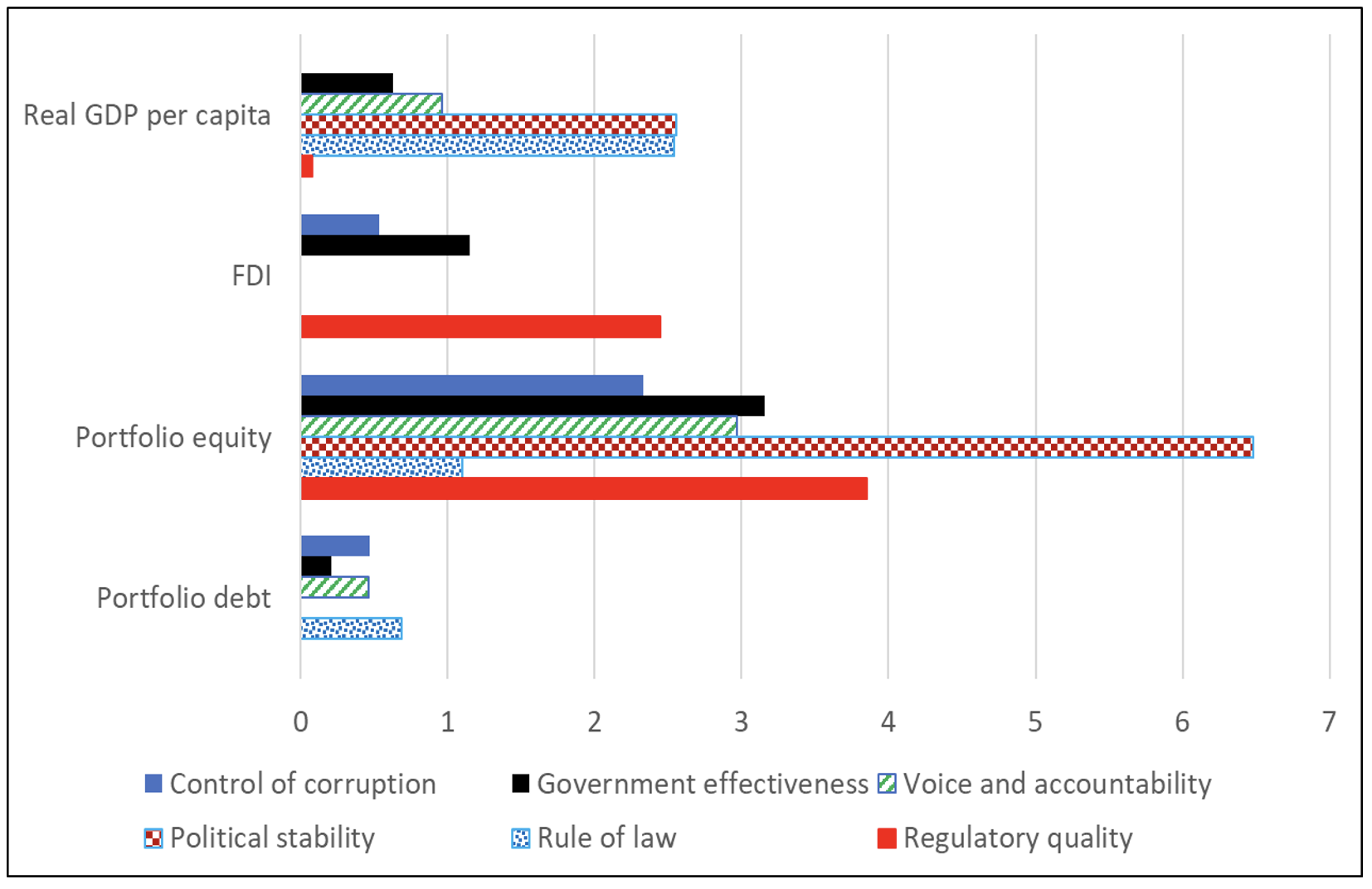

Turning to the capital flows that are more volatile in nature, net portfolio debt for economies with lower levels of institutional quality can be somewhat resilient during crisis times, with debt stabilized, although the magnitudes of the effects are small. For economies with high institutional development, even in normal times, institutions are associated with a reduction in net inflows of portfolio debt. The effect is less pronounced in crisis times, i.e., the marginal effect of institutions is less negative, which is also likely related to portfolio rebalancing effects. It also should be noted that these economies typically attract more stable and longer-term capital flows overall. Beirne and Panthi (2022) also examine the sub-components of institutions to identify which institutions are important for the resilience of real GDP per capita and capital flows (see Figure 2).

Figure 2: Total Marginal Effects of Institutions by Sub-Component

FDI = net foreign direct investment, GDP = gross domestic product.

FDI = net foreign direct investment, GDP = gross domestic product.

Note: The figure reports the total (significant) marginal effects from the regression analysis based on sub-components of institutions.

Source: Beirne and Panthi (2022).

For real GDP per capita, the main source of resilience due to institutions comes from a strong rule of law and political stability. For capital flows, political stability is also a key institutional factor for crisis resilience in respect of portfolio equity. However, we also observe an important role for regulatory quality, both for FDI and equity. Higher regulatory quality helps to support the resilience of these types of capital flows, which are longer-term and more stable in nature. This can also be an important factor affecting the effectiveness of macroprudential policy in managing capital flows (e.g., Beirne and Friedrich [2017]).

While developing solid institutions is a gradual and longer-term endeavor, policy makers in emerging economies, in particular, should intertwine their macroeconomic policy frameworks with measures to enhance institutional quality. This can have important implications for sustainable economic development and reducing exposure to financial shocks. This can also have a strong role to play in terms of enhancing the absorptive capacity of economies in the face of shocks, and accelerating the recovery speed. Institutional quality components are complex, multi-dimensional, diversified, and challenging to measure concerning their evolution.

As policy makers seek to improve the resilience of their economies to macrofinancial disturbances, it follows that structural reforms aimed at improving the quality of institutions should be central to the policy agenda over the medium-to-long term. Going forward, national authorities and international financial institutions should work together to enhance their frameworks for measuring institutional quality. In particular, a more granular understanding of the sub-components of institutional quality at the global level, particularly on harmonized cross-country data available over a long time period, would provide the basis for more targeted structural policies for enhancing long-term macrofinancial resilience.

Click to read the working paper

References

Alfaro, L., S. Kalemli-Ozcan, and V. Volosovych. 2007. Capital Flows in a Globalized World: The Role of Policies and Institutions. In Capital Controls and Capital Flows in Emerging Economies: Policies, Practices, and Consequences, edited by S. Edwards. University of Chicago Press.

Beirne, J., and C. Friedrich. 2017. Macroprudential Policies, Capital Flows, and the Structure of the Banking Sector. Journal of International Money and Finance 75: 47–68.

Beirne, J., and P. Panthi. 2022. Institutional Quality and Macrofinancial Resilience in Asia. ADBI Working Paper 1336. Tokyo: Asian Development Bank Institute.

Hall, R. E., and C. I. Jones. 1999. Why Do Some Countries Produce So Much More Output per Worker Than Others? Quarterly Journal of Economics 114(1): 83–116.

Knack, S., and P. Keefer. 1995. Institutions and Economic Performance: Cross-Country Tests Using Alternative Institutional Measures. Economics and Politics 7(3): 207–227.

Mauro, P. 1995. Corruption and Growth. Quarterly Journal of Economics 110(3): 681–712.

Osina, N. 2021. Global Governance and Gross Capital Flows Dynamics. Review of World Economics 157(3): 463–493.

Pagliari, M. S., S. A. Hannan, and M. D. Kaufman. 2017. The Volatility of Capital Flows in Emerging Markets. Washington, DC: International Monetary Fund.

Rodrik, D., A. Subramanian, and F. Trebbi. 2004. Institutions Rule: The Primacy of Institutions over Geography and Integration in Economic Development. Journal of Economic Growth 9(2): 131–165.

Comments are closed.