The World Bank’s Global Findex Survey, the primary source for global data on financial inclusion, just released its latest data for 2021 (Demirgüç-Kunt et al. 2022). Overall, it shows steady progress on financial inclusion in Asia compared with the previous survey taken in 2017, although the rates of improvement vary significantly by country. However, gender gaps in measures of financial inclusion show a very mixed pattern, with some countries showing reductions but at least as many showing increases. This is particularly the case with measures related to the use of financial technology (fintech), such as having a mobile money account or having made or received a digital transfer, suggesting that digital gender gaps remain a problem in many countries. In view of the positive role that fintech is expected to have on financial inclusion, this points to an urgent need for policies to address the digital gender gap.

Having an account

The percentage of adults having either an account at a formal financial institution, such as a bank, or a mobile money account is generally the most widely used definition of financial inclusion. For most countries, this figure is essentially the same as the share of adults having an account at a formal financial institution. However, in some countries—including Pakistan and the Philippines—the share of adults having only a mobile money account is relatively large, so the share is significantly larger than that for those having an account at a formal institution only.

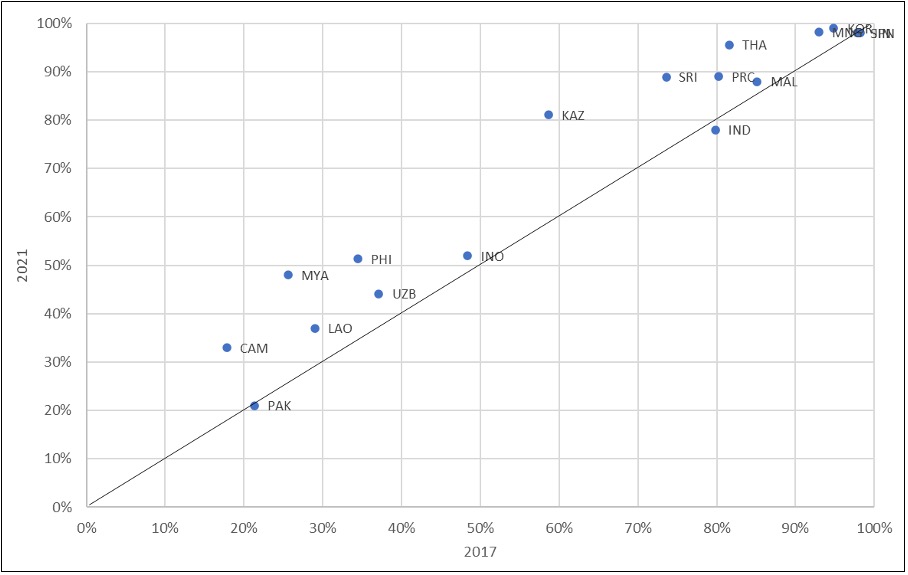

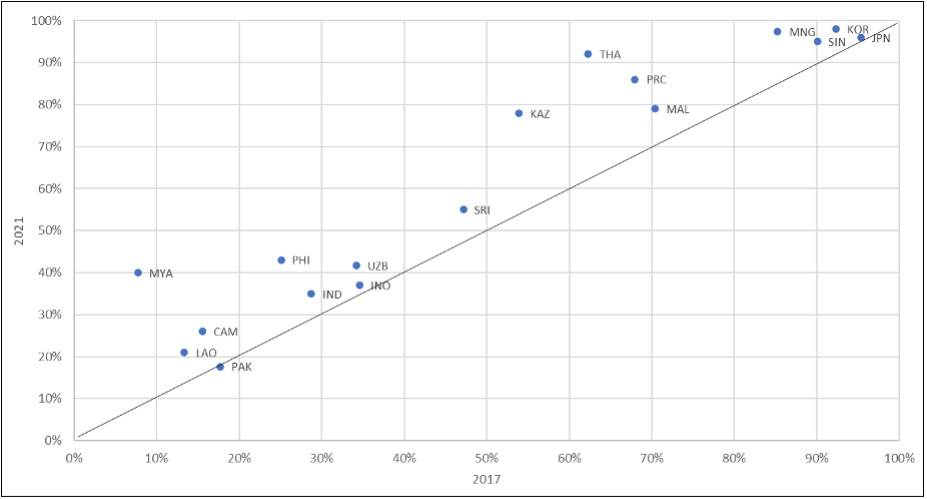

Figure 1 shows the data for 2017 and 2021 for a representative set of Asian countries. Observations above the diagonal line represent increases in financial inclusion in 2021. Countries showing large increases between 2017 and 2021 include Cambodia, Kazakhstan, the Philippines, Sri Lanka, and Thailand, while most other emerging economies except India and Pakistan showed some degree of improvement.

Figure 1: Share of Adults with an Account (%, aged 15+)

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

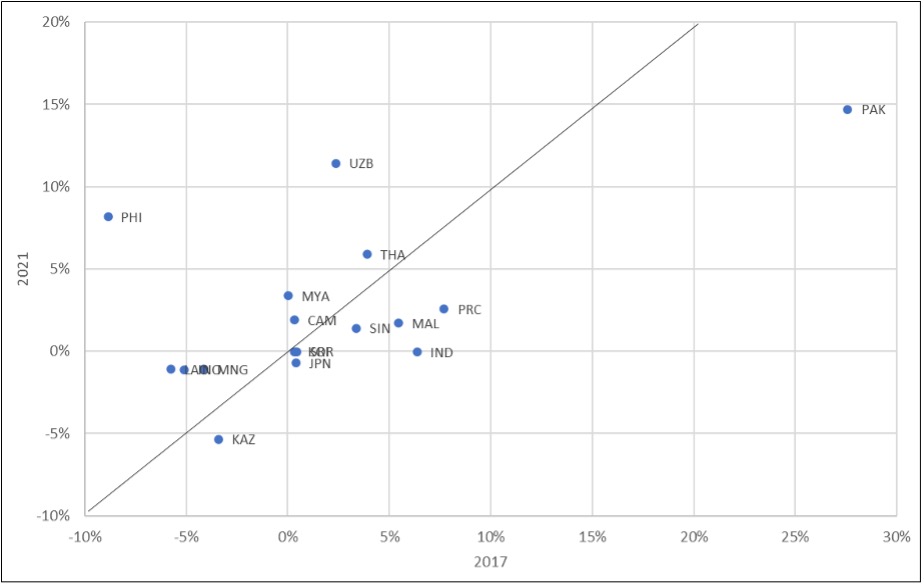

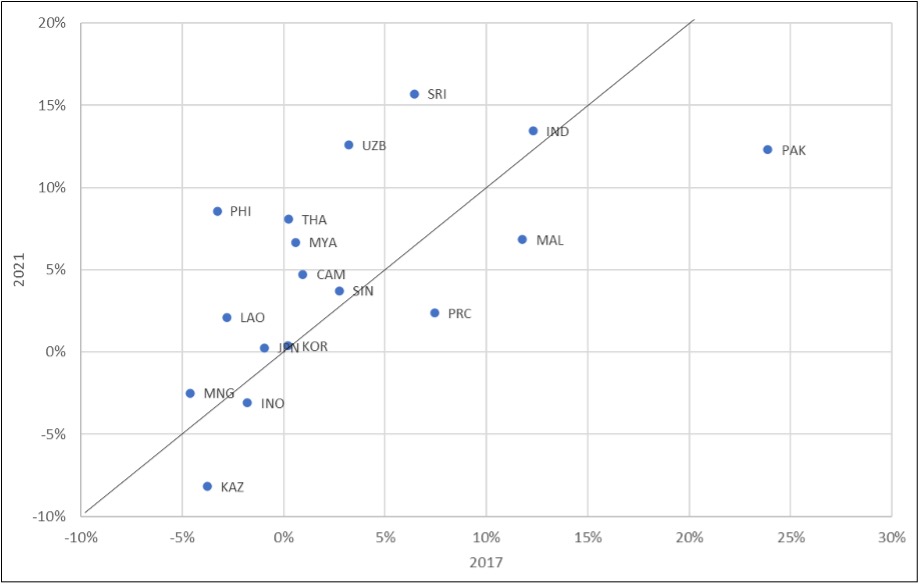

However, gender gaps remain stubbornly large. Figure 2 shows the differences between the percentages for men and women having an account for 2017 and 2021. Here, observations below the diagonal line represent a reduction in the male-female differential. There is no obvious trend, as countries are relatively evenly split between those showing reduced and increased differentials. The very big increase in the male-female gap in the Philippines and the large decrease in Pakistan seem hard to explain. Only five countries had a negative male-female differential in 2021, while the gaps for India, the Republic of Korea, and Sri Lanka were zero.

Figure 2: Male-Female Differentials for Having an Account (%, aged 15+)

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Mobile money accounts

Mobile money accounts do not require a bank account but simply access to a mobile phone, so are seen as a way to promote financial inclusion for those who find it difficult to open a bank account. They are an important application of fintech.

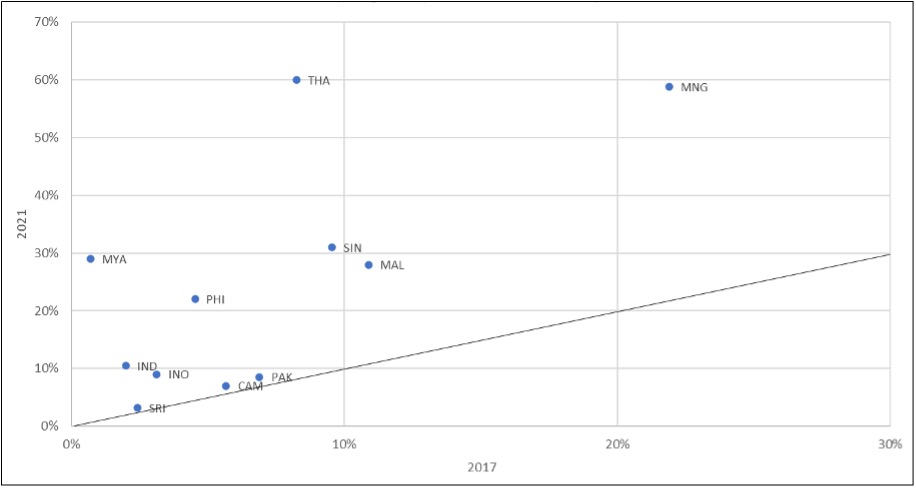

Figure 3 shows a wide trend of improvement in the percentage of adults with a mobile money account, with very large increases in Malaysia, Mongolia, the Philippines, Singapore, and Thailand. This rapid dispersion no doubt contributed to the significant increases seen in financial inclusion in some of these countries. On the other hand, mobile money accounts play only a very small role in Cambodia, Pakistan, and Sri Lanka, while data on mobile money accounts are not available for Japan, Kazakhstan, the People’s Republic of China (PRC), the Republic of Korea, and Uzbekistan.

Figure 3: Share of Adults with a Mobile Money Account (%, aged 15+)

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

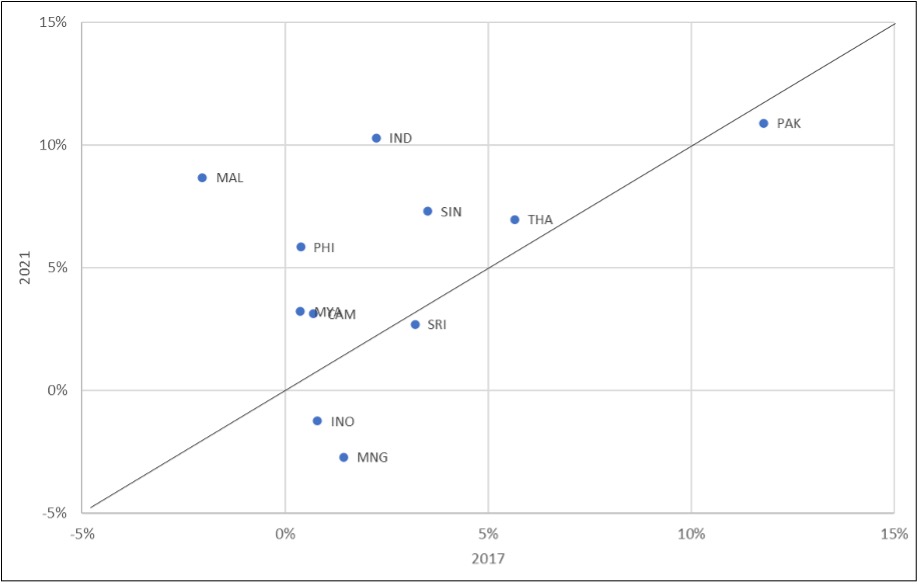

Again, however, the picture with regard to male-female differentials is less positive. Figure 4 shows the male-female differentials for holdings of a mobile money account. As before, observations below the diagonal line indicate a reduction in the male-female differential. Only four countries showed an improvement in the differential, against seven showing an increase, and only two countries showed a negative differential in 2021—Indonesia and Mongolia.

Figure 4: Male-Female Differentials for Having a Mobile Money Account (%, aged 15+)

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Digital payments

The picture is similar for the share of adults who made or received a digital payment in the past year, another important indicator of the use of fintech. Figure 5 shows the share of adults who made or received a digital payment. There was universal improvement between 2017 and 2021, with especially large increases seen in the PRC, Kazakhstan, the Philippines, and Thailand.

Figure 5: Share of Adults Who Made or Received a Digital Payment (%, aged 15+)

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Once again, however, the findings for the male-female differentials are less positive (Figure 6). Only five countries showed smaller differentials in 2021—the PRC, Indonesia, Kazakhstan, Malaysia, and Pakistan—and only three showed a negative differential in 2021—Indonesia, Kazakhstan, and Mongolia. The Philippines, Sri Lanka, Thailand, and Uzbekistan showed especially large increases in their differentials.

Figure 6: Male-Female Differentials for Having Made or Received a Digital Payment (%, aged 15+)

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Source: World Bank Global Findex Survey database (https://www.worldbank.org/en/publication/globalfindex/Data).

Is the digital gender gap the problem?

What explains this seeming trend of a widening gender gap? It seems likely to be a reflection of the digital gender gap, i.e., men are more likely to adopt digital technology earlier and more frequently than women. Given that fintech is expected to play an important role in promoting financial inclusion, the digital gender gap threatens to pose a significant barrier to increasing the financial inclusion of women. This points to the need for policies to increase both digital financial access and digital financial literacy for women. Our recent policy brief (Morgan, Huang, and Trinh 2020) highlights the need to address gender gaps in digital financial education strategies.

References

Demirgüç-Kunt, A., L. Klapper, D. Singer, and S. Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19. Washington, DC: World Bank Group.

Morgan, P., B. Huang, and L. Q. Trinh. 2020. Minding the Gaps in Digital Financial Education Strategies. Saudi Arabia T20 Policy Brief.

Comments are closed.