The final months of 2021 will be a crucial time for climate policy. At the United Nations Climate Change Conference (COP26) in Glasgow from 31 October to 12 November, countries will need to come forward and show that they take the commitments that they made in Paris seriously and that they will reduce GHG emissions such that we reach net zero by 2050 to meet the climate targets of the Paris Agreement. Carbon pricing and other fiscal policies will play a critical role.

The battle against climate change will be won or lost in Asia, where the world’s most dynamic economies are developing rapidly. Asian countries emitted 20.2 billion tons of carbon dioxide (CO2) in 2019, 55% of the global total (Ritchie and Roser 2020). In 2020, non-Organisation for Economic Co-operation and Development Asian economies produced 4.5 billion tons of non-CO2 greenhouse gases (GHGs), 44% of the global total (EPA 2020). Moreover, many countries in Asia are still developing rapidly. This development will need to be radically different to that of the old, industrialized countries if we are to meet the Paris targets.

Governments in Asia recognize the importance of building forward better and fostering a green recovery, but they also struggling to expand their economies while holding on to environmental standards. As fossil fuels meet 85% of Asia’s energy needs (Susantono et al. 2021), transitioning to clean energy becomes an important agenda for their energy security and sustainable development.

Challenges to a green recovery and green development

Recovery from an economic recession is often very GHG emissions-intensive. The current global trajectory does not show sufficient progress toward tackling climate change, and the 6.9% fall in GHG emissions in 2020 was smaller than the International Energy Agency (IEA) initially predicted (IEA 2021). There is a danger that subsidies and investments in fossil fuels, and bailouts for fossil fuel-intensive companies, will undermine the green recovery.

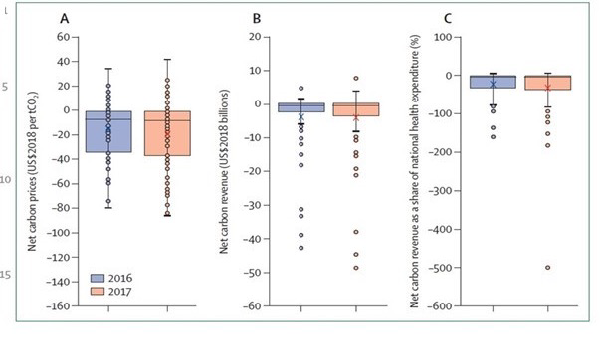

Sonobe (2021) pointed out that many countries have policies favorable to fossil fuel energies and carbon prices are far from appropriate. Indeed, Ekins (2021: 5) emphasized that the average global carbon price is currently negative, as seen in Figure 1. The resulting artificially low fossil fuel prices make it difficult for renewable energy to compete.

Figure 1. (A) Net Carbon Prices, (B) Net Carbon Revenue, and (C) Net Carbon Revenue as a Share of Current National Health Expenditure across 75 Countries in 2016 and 2017

Notes: The boxes represent the median and interquartile range, the horizontal lines inside the boxes represent the medians, and the crosses represent the means. The brackets represent the range from minimum to maximum, however, points are represented as outliers beyond this range if their values are 1–5 times the interquartile range less than the first quartile or more than the third quartile.

tCO2 = tons of carbon dioxide.

Source: The Lancet (2020).

In many countries in Asia and the Pacific, coal remains the primary source of power. Its phaseout is challenging, as it requires a number of conditions: strong political commitment, the availability of alternative technologies and substitutions, well-designed policies to drive energy transition and leverage investment in renewable energy, infrastructure and energy efficiency, and measures to help low-income households and businesses adjust.

Against this background, to discuss these challenges and highlight the importance of this agenda for the Asian Development Bank’s developing member countries, the Asian Development Bank Institute (ADBI) hosted the “Virtual Policy Dialogue on Fiscal Policy and Green Development” on 24–26 February 2021. The policy dialogue will be followed by the publication of a related book, and, together, the publication and policy dialogue aim to serve as a timely guide to the fiscal policy choices that can move us toward green and low-carbon development while addressing today’s public health and economic crises.

The policy dialogue produced a number of key findings and takeaways, which we summarize in three sections: opportunities, solutions, and subnational considerations.

Opportunities created for a green economic recovery

In the wake of the coronavirus disease (COVID-19), many governments are deploying recovery packages that are expected to jumpstart consumption, job creation, and economic growth. Some countries are including green development policies in their packages that can increase international consensus on the need to build back a better, greener, more climate resilient, and more socially inclusive economy. The recent trends in policy change and the issuance of recovery packages provide a unique one-time opportunity to turn the tides of impending climate change and build a greener economy.

The crisis can be the opportunity for countries to strengthen the structural reform agenda and put climate change and resilience at the center of policy. For example, Indonesia has taken fiscal and budgetary measures to mainstream climate in policymaking. The policies include climate budget tagging, green sukuk (green bonds), carbon pricing (a carbon market and a carbon levy), the launch of a new environmental fund (the BPDLH) and the development of a climate change fiscal framework (Kacaribu 2021).

Policy for low-carbon energy can boost GDP by 3.5% in the next 3 years (IEA 2020), and this industry is more labour intensive compared to the fossil fuel industry. A study by the Union of Concerned Scientists (2017) found that increasing renewable energy production to 25% of the energy mix by 2025 would create 3 times as many jobs as producing the same amount of energy from fossil fuels. Similarly, UKERC (2014) found that on average, the fossil fuel industry creates 0.14 jobs per GWh produced; renewable energy creates 0.65 jobs per GWh, while energy efficiency creates 0.80 jobs per GWh. This constitutes 4–6 times as many jobs for the same amount of power (Zaman 2021: 3).

Solutions: fiscal policies/carbon taxes for fostering green development

With Asia’s heavy dependence on imports and 10% of the region’s population still lacking access to electricity and air pollution in urban areas, countries need huge investment to build their economies while also meeting climate action targets. Therefore, appropriate fiscal policy choices are needed to move Asia’s societies toward green and low-carbon development while addressing today’s public health and economic crises as well as their energy needs.

Policy options on carbon taxes can provide many potential advantages, such as cost reductions, stable revenue, and stimulate investment in renewable energy, energy efficiency, and low-carbon industries. Well-designed carbon taxes also can mitigate the impact of high fossil fuel prices by stimulating energy efficiency, or mitigating the impact of low fossil fuel prices by incorporating external costs (Ekins 2021: 6). Qurratu’Ain (2021: 5) calculated that an upstream carbon tax on coal can raise revenues by around 0.87% of GDP for Indonesia.

Countries at different levels of development may need different packages of measures to drive green development. In the transport sector, Lam, Lee, and Mercure (2021: 12) found that the alignment of incentives is key to their effectiveness, e.g., scrappage schemes and fuel efficiency standards. In Indonesia and India, incentives are needed to kick-start the market for electric and hybrid vehicles.

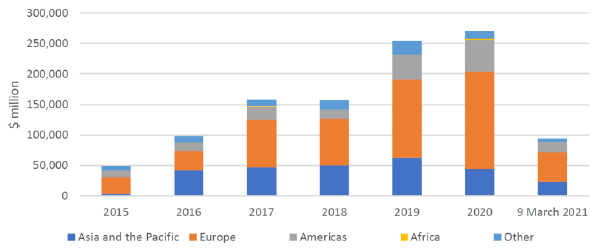

Green bond issuances are growing fast and are expected to continue to grow in 2021 (Katz 2021). Annual issuances of green bonds around the world have grown rapidly, from $3.4 billion in 2012 to $271 billion in 2020. One-fifth of green bonds are issued in Asia and the Pacific (Figure 2). Unlike conventional bonds, green bonds finance projects with clear environmental benefits. This trend can be taken by countries to develop their green financing market and support green projects. As explained by Halimatussadiah and Riefky (2021: 8), Green sukuk can be an important source of revenue for governments when fiscal capacity is limited. In Indonesia, green sukuk have raised $2.8 billion since 2019.

Figure 2. Green Bond Issuances

Source: BloombergNEF (2020).

The subnational level: local government and green development in Indonesia

Subnational governments play an important role in green development (Balbosa 2021: 4). Effective collaboration between the national and subnational levels and human capacity development and consensus building are essential to ensure that revenue is used effectively, efficiently, and sustainably. Municipal green bonds can enhance the visibility of green policies and leverage private investment. On the other hand, subnational or municipal governments have limited room to improvise with their environmental policies due to the low level of fiscal independence. In Indonesia, the spending of the municipal government on the environment is only around 1.86% of the total budget for 2011–2019 (Huda 2021: 4). There are inequalities between regions, and provinces in East Indonesia and Sulawesi may fall behind in terms of sustainability in the future (Syaifudin 2021).

National governments can use regional incentive funds as a reward mechanism to enhance local green development and boost budgetary allocation for green development. For this to function effectively, the monitoring and evaluation of local government performance also need to be improved (Huda 2021). Furthermore, countries can also use the approaches to de-risking investments for SDG implementation by aggregating smaller projects, e.g., loans for SMEs hit hard by the COVID-19 crisis, to create bankable investments for international financiers (Morgado 2021).

In conclusion, there is high awareness among national governments of the importance of green fiscal policies for green development. However, there are still many challenges in creating conducive policies and implementing green actions. Convincing stakeholders and choosing the right policies while adapting to local situations are the hardest of all. Therefore, policy discussions among national and international experts, as well as communication and highlighting of the benefits and importance of green development for stakeholders, should be held regularly. Technological and policy feedback effects can magnify these benefits: as green technologies become more mainstream, support for their application increases and organizational structures change to accommodate them, which in turn may lead to higher levels of awareness.

——

References

Balbosa, J. Z. 2021. Keynote Address: Green Recovery Financing Mechanisms at the Subnational Level. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

BloombergNEF. 2020, New Energy Outlook 2020. https://about.bnef.com/new-energy-outlook/

Ekins, P. 2021. Environmental Taxation in Asia: Grasping the Opportunities. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Tokyo: ADBI.

EPA. 2020. Non CO2: Greenhouse Gas Data Tool. https://cfpub.epa.gov/ghgdata/nonco2/

Halimatussadiah, A., and T. Riefky. 2021. The Role of Project Rating and Guarantee Provision in Addressing the Financing Gap of Green Projects through Green Bonds. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

Huda, A. M. 2021. Determinants of Green Development Implementation in Local Governments of Indonesia and Its Impact to Local Fiscal Independence. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

International Energy Agency (IEA). 2020. Sustainable Recovery: World Energy Outlook Special Report. International Energy Agency. https://www.iea.org/reports/sustainable-recovery

IEA. 2021. Global Energy Review 2021: Assessing the Effects of Economic Recoveries on Global Energy Demand and CO2 Emissions in 2021. International Energy Agency. https://www.iea.org/reports/global-energy-review-2021

Kacaribu, F. N. 2021. Opening Remarks. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Tokyo: ADBI.

Katz, M. 2021. Green Bond Issuance Sets New Record in 2020, 2 February. https://www.ai-cio.com/news/green-bond-issuance-sets-new-record-2020/

Lam, A., S. Lee, and J. F. Mercure. 2021. Policy Incentives on Mitigating CO2 Emissions from the Passenger Cars in Five Major Asian Economies: Analysis using FTT-Transport Model. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

Morgado, N. C. 2021. Keynote Address: Green Recovery Financing Mechanisms at the Subnational Level. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

Qurratu’Ain, N. 2021. Carbon Tax Adoption: Pathway to Green Indonesia. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

Ritchie, H., and M. Roser. 2020. CO₂ and Greenhouse Gas Emissions. https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions

Sonobe, T. 2021. Opening Remarks. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Tokyo: ADBI.

Susantono, B., Y. Zhai, R. M. Shrestha, and L. Mo. 2021. Financing Clean Energy in Developing Asia. Asian Development Bank (ADB).

Syaifudin, N. 2021. Sustainability and Equality Tendency Challenge: Regional evidence from Indonesia. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

The Lancet. 2020. The 2020 Report of the Lancet Countdown on Health and Climate Change: Responding to Converging Crises. https://www.thelancet.com/action/showPdf?pii=S0140-6736%2820%2932290-X

UKERC. 2014. Low Carbon Jobs: The Evidence for Net Job Creation from Policy Support for Energy Efficiency and Renewable Energy. UK Energy Research Centre. https://d2e1qxpsswcpgz.cloudfront.net/uploads/2020/03/low-carbon-jobs.pdf

Union of Concerned Scientists. 2017. Benefits of Renewable Energy Use, 20 December. https://www.ucsusa.org/resources/benefits-renewable-energy-use

World Bank. 2021. State and Trends of Carbon Pricing 2021. International Bank for Reconstruction and Development / The World Bank. https://openknowledge.worldbank.org/handle/10986/35620

Zaman, L. 2021. Financing Green Energy in a Post-COVID World: Building Back Cleaner, and more Resilient Energy Systems. Conference presentation, 24–26 February. Virtual Policy Dialogue on Post COVID-19 Fiscal Instruments and Green Development. Online.

Comments are closed.