Climate change can have a material impact on sovereign risk through direct and indirect effects on public finances. In addition, climate change raises the cost of capital in climate vulnerable countries and threatens debt sustainability. Governments must climate-proof their economies and public finances or potentially face an ever-worsening spiral of climate vulnerability and unsustainable debt burdens.

A new report, Climate Change and Sovereign Risk (Volz et al. 2020), provides a comprehensive analysis of the transmission channels from climate risk to sovereign risk and outlines policy recommendations on how to manage climate-related sovereign risk, informing an increasingly critical conversation around the financial implications of climate change and how countries can prepare for these impacts. The report emphasizes the importance for financial authorities to integrate climate risk into their risk management processes and for governments to prioritize comprehensive climate vulnerability assessments and work with the financial sector to promote investment in climate adaptation.

The research highlights the transmission channels through which climate change can amplify sovereign risk and worsen a sovereign’s standing, including the impacts of climate change on natural capital; fiscal impacts of climate-related natural disasters; fiscal consequences of adaptation and mitigation policies; macroeconomic impacts of climate change; climate-related risks and financial sector stability; impacts on international trade and capital flows; and impacts on political stability (Figure 1). These transmission channels are not independent of each other, with climate impacts magnifying the transmission of risk through multiple channels. Moreover, the socioeconomic and fiscal effects of climate change are multifaceted and depend on the policies taken or not taken to mitigate and adapt to these risks.

Figure 1: Transmission channels of risk

Source: Volz et al. (2020).

Southeast Asian countries face considerable climate-related macrofinancial stability and sovereign risk

The report provides a closer look at Southeast Asia, a region with significant exposure to climate hazards such as storms, floods, rising sea levels, heat waves, and water stress. Physical risks are expected to considerably affect economic activity, international commerce, employment, and public finances across Southeast Asian countries. Transition risks will be prominent as exports and economies become affected by international climate policies, technological change, and changing consumption patterns. The implications of climate change for macrofinancial stability and sovereign risk are likely to be material for most if not all Southeast Asian economies.

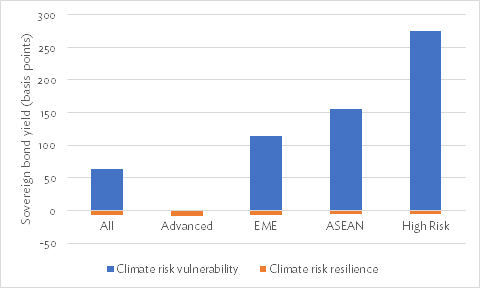

The report also presents new empirical evidence on the relationship between climate vulnerability, resilience, and the sovereign cost of capital. Using a sample of 40 developed and emerging economies, econometric analysis shows that climate vulnerability and resilience have significant effects on the cost of sovereign borrowing.1 Higher vulnerability to climate change leads to significant rises in the cost of sovereign borrowing. As shown in Figure 2, premia on sovereign bond yields amount to around 275 basis points for economies highly exposed to climate risk, compared to 155 basis points for the Association of Southeast Asian Nations, and 113 basis points for emerging market economies overall. By contrast, exposure to climate risks is not statistically significant for the group of advanced economies. Resilience to climate risk is found to be statistically significant in reducing bond yields across all country groups, but with smaller magnitudes.

Figure 2: The impact of climate risk vulnerability and climate risk resilience on the cost of sovereign borrowing

ASEAN = Association of Southeast Asian Nations, EME = emerging market economies.

Note: The y-axis refers to the climate risk coefficients from the estimation of the panel model on sovereign bond yields, expressed in basis points.

Source: Authors’ estimation, see Beirne, Renzhi, and Volz (2020).

Overall, the empirical analysis confirms that climate vulnerability has significant implications for sovereign borrowing costs, and that the magnitude of the effect is much larger for countries highly vulnerable to climate change. In addition, impulse response analysis conducted suggests that shocks imposed on climate vulnerability and resilience have permanent effects on bond yields, and that economies highly exposed to climate risks experience larger permanent effects on yields than economies with lower exposure.

Concerted efforts are needed to mitigate and manage climate-related sovereign risks

All branches of government will have to address climate-related risks. Monetary and financial authorities will have to play crucial roles in analyzing and mitigating macrofinancial risks. The report recommends five broad policy actions to mitigate and manage climate-related sovereign risk in a coordinated manner:

First, governments need to conduct comprehensive sectoral and national vulnerability assessments over multiple timespans to identify climate-related sovereign risk and develop a national adaptation plan. A systematic, scenario-based assessment of all sources of vulnerability for the macroeconomy, the financial system, and public finances is needed, addressing both the physical and transition risks. Such an assessment could be conducted by a dedicated national climate risk board that should include the central bank and supervisor along with key government departments responsible for finance, the economy, planning, and agriculture, among others.

Second, based on vulnerability assessments, financial authorities need to mainstream climate risk analysis into public financial management. This should include the appropriate disclosure, analysis, and management of climate risks to public finances. Budgetary processes need to account for climate risk and mainstream climate-relevant policies and laws. Furthermore, finance ministries need to enhance public sector funding and debt management strategies, including through debt instruments with risk-sharing features and the diversification of government revenue streams away from high-risk sectors.

Third, central banks and financial supervisors need to address climate-related risks in their monetary and prudential frameworks and operations. The disclosure of climate and other sustainability risks should become mandatory, and climate stress tests of financial institutions should be conducted regularly. Climate-related financial risks should be mainstreamed into macro and micro prudential supervision, while monetary and prudential measures should be aligned with climate goals. Importantly, supervisors should reconsider the prudential treatment of sovereign exposures in financial regulation.

Fourth, governments and financial authorities should implement financial sector policies to scale-up investment in climate adaptation and develop insurance solutions. Monetary and financial authorities can play an important role in supporting the development of local currency bond markets and fintech solutions for mobilizing domestic savings for financing climate-resilient, sustainable infrastructure and other adaptation measures. Developing insurance markets and broadening insurance coverage can help to enhance the financial resilience of households and businesses and alleviate the extent of the burden on public finances.

Fifth, international financial institutions—including the International Monetary Fund, multilateral development banks, and regional financing arrangements—have a special role in supporting vulnerable countries to better address climate-related sovereign risks and strengthen adaptive capacity and macrofinancial resilience. Building on their respective strengths, they can provide technical assistance and training, support surveillance and risk monitoring, provide finance for adaptation and resilience investment, help develop insurance solutions, and provide emergency lending and crisis support.

_____

1 See Beirne, Renzhi, and Volz (2020) for the technical paper upon which this analysis is based.

References:

Beirne, J., N. Renzhi, and U. Volz. 2020. Feeling the Heat: Climate Risks and the Cost of Sovereign Borrowing. ADBI Working Paper 1160. Tokyo: ADBI.

Volz, U., J. Beirne, N. Ambrosio Preudhomme, A. Fenton, E. Mazzacurati, N. Renzhi, and J. Stampe. 2020. Climate Change and Sovereign Risk. London, Tokyo, Singapore, and Berkeley, CA: SOAS University of London, ADBI, World Wide Fund for Nature Singapore, and Four Twenty Seven.

Comments are closed.