The 2030 Agenda for Sustainable Development has many services dimensions; improved access to and provision of services are necessary for attaining many of the Sustainable Development Goals. Because of their effects on competition in services markets and the ability of foreign providers to supply services to consumers and firms in developing countries, services trade policies should be considered in the arsenal of policy instruments that can be used in efforts to realize sustainable development objectives.

Services are important for sustainable development for at least two reasons. First, services matter for economic growth. Financial services are critical in providing funds to firms for investments and working capital. Connectivity, whether facilitating the physical movement of goods and people (transport services) or the exchange of knowledge and information (telecommunications services), is all about services. Information and communication technology (ICT) services, the internet, and electronic or e-commerce platforms provide the means for products to be exchanged between businesses or sold to final consumers, including increasingly products that can be digitized. Business services such as accounting, engineering, consulting, and legal services reduce transaction costs associated with the operation of markets and the enforcement of contracts, and they are a channel through which process innovations are transmitted across firms in an industry and across industries. In short, the performance of a wide range of services sectors matters for the overall productivity of the economy and growth in per capita incomes.

Sustainable development is of course not limited to economic growth and increasing per capita incomes. This is clear from the multidimensional nature of the Sustainable Development Goals (SDGs). These span 17 broad objectives ranging from reducing poverty to improving public health and protecting the environment. The second reason services matter for sustainable development is that service sector performance is salient for many “non-income” dimensions of the SDGs. The specific targets associated with 11 of the 17 SDGs explicitly refer to access to services or quality improvement in at least one distinct sector as a means of attaining the goal in question. For instance, financial services are mentioned in the context of SDG 1 (end poverty in all its forms everywhere) where “access to […] financial services, including microfinance” is part of target 1.4. Access to financial services is also explicitly required to end hunger, achieve food security and improved nutrition, and promote sustainable agriculture (SDG 2), to ensure healthy lives and promote well-being for all at all ages (SDG 3), to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all (SDG 8), and to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation (SDG 9).1

Trade and investment are key channels through which consumers and firms can improve access to higher-quality, more varied, and cheaper services. Moreover, trade and investment can potentially improve the performance of domestic services sectors through competitive pressures and knowledge spillovers. An important stylized fact in this regard is that trade costs for services are much higher than trade costs for goods. One reason for this is that governments maintain restrictive policies toward trade and investment. Reducing services trade restrictions therefore is a potentially salient instrument in the context of efforts to realize the SDGs.

In a recent paper (Fiorini and Hoekman 2018), we show that more open services trade policies appear to have a strong association with availability of (access to) several services that figure prominently in several SDGs, specifically financial, ICT, and transport services. Our findings suggest that removing policy barriers to services trade and investment may matter more for enhancing access to services than for increasing overall economic growth, although we also find that more open trade policy regimes toward transport services are positively associated with per capita income levels.

Our analysis further illustrates that reform of trade and investment policy alone might not be sufficient to improve access to services. Because of the intangible nature of services, foreign providers (exporters and investors) must generate at least part—and often much—of the value added of their economic activity in the importing country. They will therefore be affected by the local business environment. This in turn implies that the magnitude of the potential positive effects of a more open trade and investment regime may be conditional on the quality of institutions in the liberalizing economy (Beverelli, Fiorini, and Hoekman 2017).

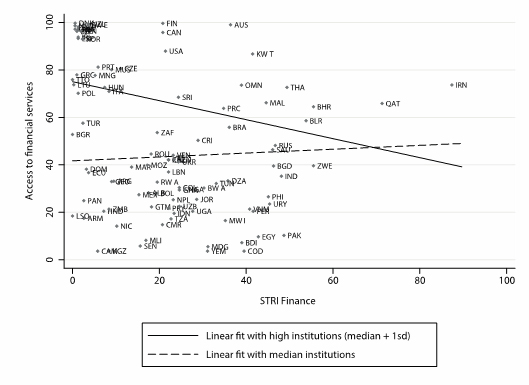

Consider, for instance, financial services. The figure below shows that countries with lower barriers to trade and investment in financial services, as measured by the Services Trade Restrictiveness Index compiled by the World Bank, tend to perform better in terms of household access to financial services only when the quality of their institutions is high enough.2 This relationship is represented by the downward slope of the solid line. In the case of countries with low-quality institutions, there is no positive association between open trade regimes and domestic access to financial services (as can be seen by the dashed line).

Access to Financial Services, Services Trade Policy, and Institutions

STRI = Services Trade Restrictiveness Index.

Source: Authors.

That trade and trade policy are a means of implementing sustainable development has long been understood. However, the text of the SDGs tends to put the emphasis on measures to facilitate or promote developing country merchandise exports. Our research suggests this is too limited. The focus should extend to policies affecting imports of services and inward investment by service suppliers, as these can affect the availability and quality of a range of services that are relevant for specific SDGs. At the same time, greater focus on services trade restrictions needs to be complemented by greater attention to the quality of regulatory and economic governance institutions that have a major bearing on the magnitude of the potential positive effects of services trade and investment reform.

_____

1 See https://sustainabledevelopment.un.org/topics/sustainabledevelopmentgoals for the more detailed targets for each SDG.

2 Access to financial services is measured using the share of population above 15 years of age with an account at a formal financial institution. Data are sourced from the Global Financial Development Database of the World Bank. Quality of institutions is proxied with regulatory quality as measured in the Worldwide Governance Indicators database.

References:

Beverelli, C., M. Fiorini, and B. Hoekman. 2017. Services Trade Policy and Manufacturing Productivity: The Role of Institutions. Journal of International Economics 104(C):166–82.

Fiorini, M., and B. Hoekman. 2018. Restrictiveness of Services Trade Policy and the Sustainable Development Goals. ADBI Working Paper 903. Tokyo: Asian Development Bank Institute.

Comments are closed.