More than 1 billion adult Asians rely on the region’s 350,000 post offices. Over 2 million employees in more than 350,000 post offices and agents across Asia serve 1 billion of the 3.2 billion adults in the region (more than 57% of the world’s adult population) by providing basic financial services, including the receipt of remittances. The majority of the users live in rural communities or peri-urban areas, often at a considerable distance from bank branches, and consider post offices as an immediate access point to financial services.

The main activity of post offices in Asia has become providing access to financial services. This fact confirms the impact of progressive reforms in Asian postal networks. In several Asian states, the market share of retail financial services has grown through strengthening distribution, and this has often started with remittances. In markets where post offices play an active role, the cost of remittances is low and already close to the targets set for the 2030 Sustainable Development Goals. Post offices that are active in remittances tend to make the market more competitive, increase transparency, and contribute to lowering costs and decreasing pick-up times.

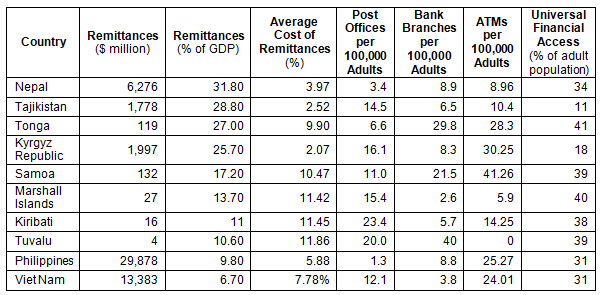

In nearly all of the top 10 remittance-receiving countries (measured as the percentage of gross domestic product), postal networks provide a relevant presence in the last mile to deliver remittances and expand access to financial services (Table 1). However, in 9 of the 10 cases, the role of the postal network is marginal or nil. The exception is Viet Nam, where post offices work in partnership with banks, money transfer operators, and FinTech in delivering remittances and financial inclusion. In the cases of the Kyrgyz Republic and Tajikistan, post offices are active in a narrow range of the distribution and collection of cash payments. In all cases, the opportunities are obvious for triggering the delivery of remittances and leveraging the postal network to advance financial inclusion.

Table 1: Top 10 Remittance Receiving Countries and the Financial Access Infrastructure

Note: The average cost of remittances is expressed as a percentage of the amount sent. For example, 3.97% for Nepal means than for the average amount of $200 nearly $8 in costs are paid for transfer fees and currency exchange.

Source: International Monetary Fund Financial Access Survey statistics 2015; Universal Postal Union Postal Statistics 2015; World Bank Remittance Prices Worldwide 2016 (http://remittanceprices.worldbank.org).

Post offices are seeking a new place in the market where cashless and digital (financial) services can rapidly grow in increasingly diverse ecosystems. This adds to the challenges for postal operators. Mobile money agents’ networks can quickly expand, but in most cases they provide access only to a very narrow and limited range of financial services. Commercial banks tend to close rural branches and focus on expanding through ATMs, agency banking, self-service terminals, and other channels.

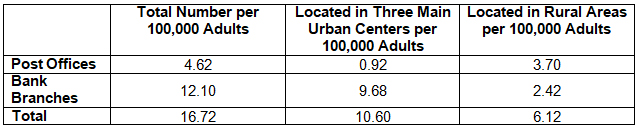

Furthermore, in several Asian markets, microfinance outlets, rural cooperative and agricultural banks, and savings and loan associations have widespread networks. Post offices in Asia appear to be able to fulfill a very special place in the financial service ecosystem. Post offices can be particularly useful for segments of the population underserved by financial institutions, from elderly people to women and from young to rural households (Table 2).

Table 2: Post Offices in Asia Fill Large Gaps in the Rural Financial Infrastructure

Source: International Monetary Fund Financial Access Survey 2015, Universal Postal Union Postal Statistics 2015.

Postal networks are instrumental for achieving equal access to formal financial services for all. Post offices are often considered to be trusted and convenient places, with staff able to explain and provide financial services to everybody, and also places where cash is always available.

The familiar, social atmosphere of post offices is attractive for poorer, rural populations who might be hesitant to enter bank branches. Post offices can provide a “one-stop shop” for a range of basic financial services in a cross-selling package with other social, public, and digital services, such as e-commerce and e-government services.

Post offices also differ from mobile money agents, who often only have small amounts of cash on hand and provide only the cash-in and cash-out of mobile money. A critical difference is in network management. Whereas the postal network has a certain capacity in managing post offices as a single network, challenges exist for mobile money operators in arranging cash supply and keeping control of their agency networks, which are made up of many individuals.

Development agencies and financial regulators could play a larger role in supporting post offices that offer greater value with broader and deeper access to financial services, especially when coupled with financial education.

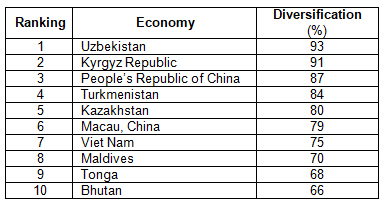

Table 3: Asian Postal Operators Are Moving Rapidly Toward the Diversification of Revenues

Note: Diversification comprises all non-postal logistics (mail, parcel, express) revenues.

Source: Universal Postal Union Postal Statistics 2015.

Postal reforms in Asia are still incomplete in many cases. Further progress is needed to truly bring post offices into the digital financial services era. Improvements in the technical conditions of post offices, such as power supply, broadband connectivity, and information and communications technology equipment, have shown to be critical, but they are not enough.

Recent progress in Asia, as seen, for example, in the People’s Republic of China, India, Indonesia, and Japan, confirms again that reforms need to encompass institutional changes, too. While some national postal operators are pursuing mainly organic growth with in-house technology, many others are transforming into group companies and building multiple partnerships with private enterprises, FinTechs, and financial institutions. Post offices are on the way to becoming “supermarkets” or “convenience shops” for remittances, financial inclusion, and other e-services.

To accomplish true financial inclusion, postal operators pursuing such development also need extensive training and capacity-building, especially in marketing and financial management. Regulators face challenges in bridging the gap with which many nonprofit organizations struggle—namely, the gap between the regulators that consider financial services via post offices an essential part of the postal services and the financial regulators themselves. Regulatory coordination is needed. The potential of post offices as a financial access infrastructure component lies in closing the gaps in rural access and in increasing competitiveness for the underserved population.

Photo: By sridutt2 (“Post Box Mail Delivery Shipping Postal Paper“). Licensed under CC0 1.0 Universal (CC0 1.0)

Comments are closed.