Share of SMEs in the Thai economy

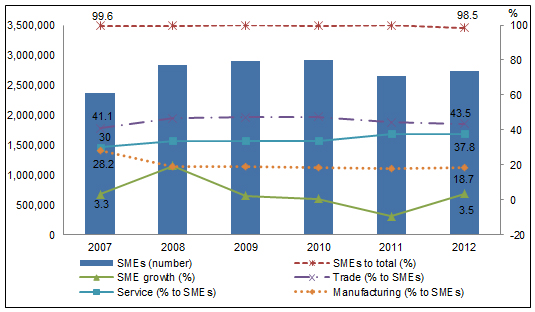

Small and medium-sized enterprises (SMEs) play a significant role in the Thai economy. In 2012 there were 2.7 million SMEs in Thailand (see Figure 1) comprising 98.5% of total enterprises. In the same year, SMEs accounted for 37.0% of gross domestic product (GDP) and 80.4% of the workforce. Thai SMEs also contributed to 28.8% of total exports and 31.9% of total imports by value in 2012.

In Thailand, the percentage of SME employment to total employment grew steadily from 76.0% in 2007 to 83.9% in 2011, but fell back to 80.4% in 2012. During the same period, the services, trade, and manufacturing sectors each contributed to more than 30% of employment by SMEs. Sector wise, employment by trading SMEs increased by about 5%, but that of manufacturing declined by 6.2%, which can be attributed to the decline in the growth rate of SMEs in the sector. The growth rate of employment by SMEs dropped from 8.3% in 2010 to 7.3% in 2012.

While the contribution of SMEs to total GDP in Thailand, at 37%, is higher than in Malaysia, at 32.7%, it lags far behind Indonesia, where SMEs contributed to 59.1% of GDP in 2012. The contribution of SMEs to GDP in Thailand declined by 1.7% in the period 2007–2012, while Malaysia and Indonesia saw a rise in the contribution of SMEs to their GDPs in the same period.

Since 2010, imports by Thai SMEs have been greater than exports. Import growth, which was negative in 2007, at –8.8%, further plummeted to –21% in 2009, but increased to 3.5% in 2007. The fact that the proportion of manufacturing SMEs has been declining has resulted in greater imports. The growth rates of imports and exports were around 3.5% in 2012.

Since SMEs are so important for the Thai economy, it is important to increase their resilience. One of the ways to increase their resilience is to provide them with stable finance. SME credit, which amounted to 32.8% of total commercial bank loans in 2012, is still small in scale. Conversely, the ratio of non-performing loans (NPLs) remains high in SME lending, at 3.4% compared with a gross NPL rate of 2.2% in Q2 2013. While the strong appetite of SMEs for growth has shifted bank lending attitudes from large lot transactions with large firms to retail financing and portfolio guarantee schemes and helped the trend of SME credit in Thailand, the lack of collateral is still a critical barrier for Thai SMEs in raising business funds (ADB 2014).

Figure 1: SMEs in Thailand

SME = small and medium-sized enterprise.

Note: Numbers refer to the left-hand scale and percentages refer to the right-hand scale.

Source: ADB (2014).

How to overcome SME financing obstacles?

Many large firms today grew from small and medium-scale enterprises. Access to the credit market is indispensable for SMEs to grow. Large credit rating firms, such as Moody’s, Standard & Poor’s, and Fitch, usually rate large firms. Thus, large firms can have easy access to credit provided they are financially sound. In the case of SMEs, such rating schemes are scarce. Due to the lack of credit rating indices, it is natural that banks perceive investment on SMEs to be risky. From the lender’s point of view, it is costly to examine the financial health of each and every SME. This cost is also passed on to SMEs, thereby increasing their borrowing costs.

Developing a credit rating index would not only shield banks from risky lending by reducing information asymmetry, but also lower borrowing costs for SMEs that have good financial health and strong growth prospects. Yoshino and Taghizadeh-Hesary (2014) propose a scheme for statistical analysis of the quality of SMEs, which could be helpful for facilitating bank financing to SMEs.

In a more recent study, Yoshino et al. (2015) show how a credit rating scheme for SMEs can be developed and implemented using data on lending by banks to SMEs, even when access to other financial and non-financial ratios is not available. Loan variables of SMEs from the Commercial Credit Scoring Data 2015 of the National Credit Bureau of Thailand are used for the credit risk analysis.

Given the lack of comprehensive credit rating agencies and indices for SMEs, financial institutions can employ these techniques to reduce information asymmetry and consequently set interest rates and lending ceilings for lending to SMEs. This would reduce borrowing costs, i.e., lower interest rates for financially healthy SMEs, and even make possible lending to healthy SMEs without the need for collateral. Finally, this would help financial institutions to avoid lending to risky SMEs and would reduce banks’ NPLs to SMEs.

_____

References:

ADB. 2014. Asia SME Monitor 2013. Manila: ADB.

Yoshino, N., and F. Taghizadeh-Hesary. 2014. Analytical Framework on Credit Risks for Financing SMEs in Asia. Asia-Pacific Development Journal 21(2): 1–21.

Yoshino, N., F. Taghizadeh-Hesary, P. Charoensivakorn, and B. Niraula. 2015. SME Credit Risk Analysis Using Bank Lending Data: An Analysis of Thai SMEs. ADBI Working Paper 536. Tokyo: Asian Development Bank Institute.