Regionalism in Asia led by global value chains (GVCs) and free trade agreements (FTAs) has increasingly put the spotlight on small and medium-sized enterprises (SMEs). As one of Asia’s success stories in internationalization, Malaysia offers interesting insights. Drawing on research on Malaysian enterprises, this article examines the characteristics of SMEs which have successfully internationalized by participating in GVCs and FTAs and explores their policy implications. It seeks to improve our understanding of the internationalization of SMEs in Asia and contribute to the scant literature.

Why SME internationalization matters

Now more than ever, SMEs in Asia have the opportunity to engage in international trade given the falling barriers to trade and fragmentation of production whereby the production of final goods is spread over firms located in several countries, with each one undertaking an individual “task” in the overall process. Firms no longer need to have the expertise to export to a modern market; instead, they can simply support the value chain as suppliers of intermediate inputs, such as parts and components, and act as subcontractors several levels down from the ultimate buyer.

Increased internationalization through trade and participation in GVCs provides SMEs in Asia the opportunity to achieve economies of scale, expand market share, and increase productivity. Additionally, participation in GVCs and cooperation within a network of upstream and downstream partners can enhance a firm’s information flows and learning possibilities, as well as introduce new business practices and more advanced technology leading to greater growth and earning potential. Despite the substantial gains from internationalization, SMEs are underrepresented in international trade even in middle-income economies in Asia. In Malaysia, SMEs account for 97% of all enterprises but only 19% of total exports.1

At the firm level, there are considerable benefits of joining the GVC and using FTA preferences, but there are also costs, and SMEs are particularly disadvantaged given their size and available resources. An established body of trade, industrial organization, and technology literature points to the overwhelming importance of firm-specific factors on which competitive advantages are built when it comes to the use of FTA preferences and participation in GVC trade.

With the increased availability of micro data, we can better understand the firm-level characteristics associated with successful participation in GVCs and use of FTA preferences as well as barriers to SME internationalization. In a forthcoming paper, we address these issues with reference to SMEs2 in Malaysia using enterprise survey data of 234 exporters and importers collected in 2012.3

Global value chains and free trade agreements in Malaysia

Malaysia is an interesting case study given its considerable engagement in GVC trade and active pursuit of liberalization through various routes including FTAs. Although the People’s Republic of China increasingly dominates Asia’s GVC trade, Malaysia has also done quite well. It accounted for 2.7% of global and 5.2% of Asia’s GVC trade over the period 2009–2013.4 Interestingly, Malaysia ranks as the fourth most active Asian economy in GVC trade and is only behind the People’s Republic of China, Japan, and the Republic of Korea. The electronics sector is particularly exposed and is the key driver of Malaysia’s participation in these chains. Relatively good infrastructure, bureaucratic efficiency when dealing with multinational corporations, political stability, abundant cheap local and foreign labor, and an English-speaking labor force were some drawcards that distinguished Malaysia from other countries for electronics firms looking to develop locations for labor-intensive assembly activities.

Malaysia has been following the dual track of negotiating multilateral trade agreements as well as bilateral FTAs as a way of strengthening commercial diplomacy, achieving quicker and higher levels of liberalization, and fostering GVC participation. Since signing the Association of Southeast Asian Nations Free Trade Area (AFTA) in 1993, Malaysia’s network of FTAs has grown to 12 bilateral and regional FTAs by 2014 with 18 trading partners. A further six agreements are under negotiation.5

Main findings from Malaysian SMEs

In the analysis of SME characteristics associated with greater internationalization via participation in GVC trade and FTAs, the following were observed in our research:

SME size still matters in GVC participation and FTA use. Even among SMEs, firm size was found to be positively and significantly associated with participation in GVCs and FTA use. The analysis found that the probability of participating in GVCs increases from 16% to 22% when the firm size increases from 25 to 50 employees. It increases further from 29% to 37% when the firm size increases from 75 to 100 employees. This key result highlights that economies of scale and firm resources, which are positively linked with size, are important in overcoming the initial fixed cost of entering the value chain and maintaining a foothold.

When considering FTA use, the probability of use increases from 17% to 25% as the firm size increases from 25 to 50 employees and further from 34% to 44% as firm size increases from 75 to 100 employees. This suggests that utilization of FTAs is not without costs—firms will have to learn and understand the FTA provisions, tailor business plans to complex tariff schedules, and obtain certificates of origin. Larger firms are better able to garner these resources than smaller firms.

SMEs that invest in technology and those with high labor productivity are more likely to be part of the GVC. In addition to size, the technological capability of enterprises, as captured by ownership of a foreign technology license and research and development (R&D) share of sales, was found to be positively and significantly associated with SME participation in GVC trade. The productivity of SME employees, as measured by total sales per unit of labor, was also found to be positively related to participation in value chains. This suggests that the extent to which a firm actively engages in improving its technology, production, and processes positively influences its participation in GVCs. Surprisingly, foreign ownership was not found to be a significant predictor of value chain participation.

A good understanding of FTA provisions and exposure to trade results in greater use of FTAs. Firms that have invested time to acquire relevant in-house FTA expertise and those that actively build linkages with FTA support institutions were found to be more likely to use FTAs. The study also found a positive and significant relationship between exposure to trade, as measured by export share of sales and the proportion of raw materials imported, and FTA use. This result is not surprising since the greater the outward orientation the higher the likelihood the firm is aware of international markets and trade regulations (including import tariffs, FTA preferences, rules of origin, and custom procedures). Additionally, firms with higher exposure to international trade have more to gain by using preferences made available in FTAs.

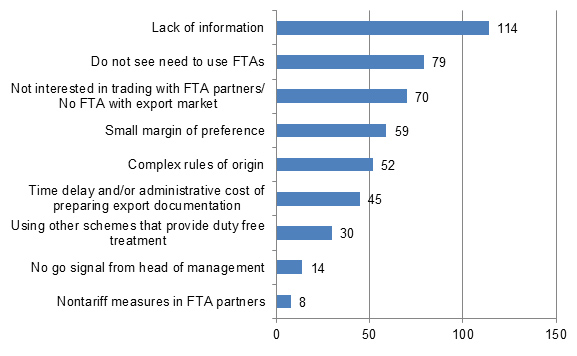

Lack of information is the predominant reason for not utilizing preferences under an FTA. When asked to rank the barriers to using FTAs, the overwhelming response among the firms surveyed was “lack of information about FTAs.” A total of 114 out of the 234 respondents ranked lack of information as one of their top three barriers to using FTAs. The other top responses included “Do not see need to use FTAs” and “Not interested in trading with FTA partners/No FTA with key export market” (see Figure 1).

Figure 1: Malaysian Firm Perceptions of Barriers to FTA Use

Source: Authors’ calculations using survey data.

Policy implications

Increased participation in production networks and use of FTAs could be a potent means of accelerating economic development. Analysis of SME characteristics that are associated with greater internationalization via participation in GVCs and use of FTAs in Malaysia reinforces what researchers have known from studies of international trade—investment in innovation, R&D, and higher education are positively related to business internationalization. In order to promote greater SME internationalization, policies can be better formulated to support SME internationalization. Some policy options include offering special financing arrangements such as state guarantees and/or tax incentives for research activities, particularly in the early stages of development; better cooperation and access to government-supported research centers including universities; and offering public support for basic education. Finally, SME concerns about the lack of information on FTAs can be addressed by providing more information on the implications of FTAs on businesses, more training on FTAs under implementation, and enhanced consultations before, during, and after FTA negotiations. With these policies in place, SMEs in Asia may internationalize more efficiently.

_____

1 D.H. Hashim. 2012. Overview of SME Sector in Malaysia. Presentation of SME Corp Malaysia at Malaysia–India SME Forum, Kuala Lumpur, 23 September. Available here.

2 SMEs were defined as firms with less than 100 employees.

3 M. Arudchelvan and G. Wignaraja. Forthcoming. Internationalization of Small and Medium-Sized Enterprises through Global Value Chains and Free Trade Agreements: Malaysian Evidence. ADBI Working Paper. Tokyo: ADBI.

4 Authors’ calculation based on trade in parts and components using the gross trade approach.

5 ADB. 2014. Asia Regional Integration Center FTA Database. Data as of July 2014.

Comments are closed.