In 2007, the 10-member Association of Southeast Asian Nations (ASEAN) bloc adopted the goal of creating an integrated economic region—termed the ASEAN Economic Community (AEC)—by December 2015. However, concerns have been expressed that the regional integration project’s 2015 deadline will be missed due to an overly ambitious timeline and too many ill-thought-out initiatives. With the AEC deadline looming, this article critically assesses the progress that has been made, charts some of the main challenges, and suggests the next steps for the AEC.

Assessing progress

The AEC project’s integrated ASEAN economic region was built on four pillars of integration: (i) a single market and production base, (ii) a competitive economic region, (iii) equitable economic development, and (iv) integration with the global economy. The AEC Blueprint (ASEAN Secretariat 2008), signed by the ASEAN leaders on 20 November 2007 during the 13th ASEAN Summit, serves as its road map. The AEC Scorecard was formulated to track the progress of the members in implementing the plans for the AEC.

Notable progress has been made on the AEC’s first pillar, which is fundamental to developing a single market and a production base in goods. Tariffs have been substantially reduced, with more than 70% of intra-regional trade in ASEAN enjoying zero tariffs, and less than 5% of goods trade being subjected to tariffs of more than 10%. These developments will encourage intra-ASEAN trade in manufacturing and agricultural goods. Although progress has been made with the signing of mutual recognition agreements in seven professions, implementation of the trade in services agreement is much slower. In part, this is linked to the activities of powerful national service lobbies.

Slow yet steady progress has been seen in realizing the goals of liberalizing investment and capital flows. The signing of the ASEAN Comprehensive Investment Agreement in 2012 was an important step in building a better business environment for the private sector in the region. Moreover, to enhance trade facilitation, the National Single Window (NSW) program is currently being implemented in the ASEAN-6 countries (Brunei Darussalam, Indonesia, Malaysia, the Philippines, Singapore, and Thailand). The remaining members are catching up, with Viet Nam and Cambodia having set up their respective NSW Customs interface. Initiatives to connect the NSWs to the ASEAN regional portal are also under way and will contribute significantly to reducing trade costs in the future.

Modest achievements are visible in the second and third pillars of the AEC. Among the highlights are the adoption of the ASEAN Intellectual Property Rights Action Plan 2011–2015 to strengthen intellectual property institutions in the region; the adoption of the Master Plan on ASEAN Connectivity to enhance the region’s transport connectivity and energy security; and the implementation of the ASEAN Strategic Action Plan for Small and Medium-Sized Enterprise (SME) Development, which aims to give guidance on the flagship projects and other SME initiatives in the region to facilitate inclusive growth.

Meanwhile, the implementation of the fourth pillar has progressed well over the past decade. ASEAN has emerged as the hub of free trade agreement (FTA) activity in Asia and plays a leadership role in negotiating trade rules for connecting Asia. FTAs have been concluded with ASEAN’s six dialogue partners: Australia, the People’s Republic of China, India, Japan, the Republic of Korea, and New Zealand. Moreover, negotiations for the Regional Comprehensive Economic Partnership (RCEP), covering ASEAN and its dialogue partners, were launched in 2012. If signed and implemented, RCEP will become the world’s biggest trade bloc, with comprehensive trade rules covering 40% of world trade, and will provide significant economic gains to members (Wignaraja 2014).

Challenges

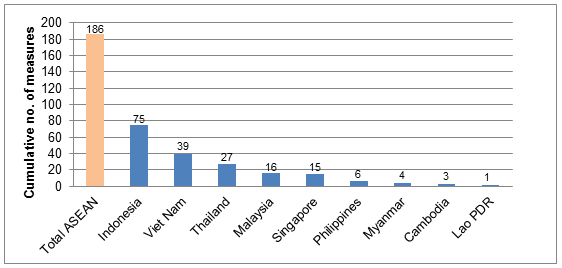

While ASEAN has largely attained the goals of the first pillar of the AEC, there are still remaining issues to be addressed. According to the Global Trade Alert database, nontariff measures have been rising in the biggest ASEAN economies since the global financial crisis. From 2009 to 2013, a total of 186 nontariff measures were implemented. Most of them were applied by the bigger economies: 75 by Indonesia, 39 by Viet Nam, 27 by Thailand, 16 by Malaysia, and 15 by Singapore (Figure 1).

Figure 1: Nontariff Protectionist Measures Implemented in ASEAN, 2009–2013

ASEAN = Association of Southeast Asian Nations, Lao PDR = Lao People’s Democratic Republic.

Source: Global Trade Alert database (http://www.globaltradealert.org/, accessed October 2014).

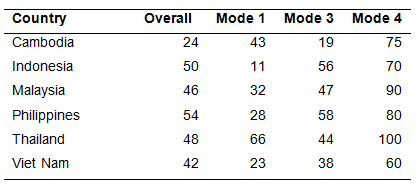

Services trade is also limited due to restrictions in most member economies, with the exception of Singapore. Based on the World Bank’s Services Trade Restrictions Database, the middle-income economies in ASEAN—Indonesia, Malaysia, the Philippines, and Thailand—have “virtually closed” to “completely closed” policy regimes in mode 4 (professional services). Overall, the services trade regimes in middle-income ASEAN range from “restrictive” to “virtually closed” (Table 1). One difficult outstanding issue is the legal protection of migrant workers. While ASEAN adopted the Declaration on the Protection and Promotion of the Rights of Migrant Workers in 2007, the debate between sending and receiving countries continues as sending member states push for a legally binding regional agreement, while receiving countries call for non-legally binding guidelines. There are also unresolved issues about the definition and contents of the agreement, which have resulted in a deadlock. Currently, existing bilateral and regional instruments to regulate services trade are too weak. Developing a strong regulatory framework remains to be one of the biggest challenges for trade in services in ASEAN.

Table 1: ASEAN Services Trade Restrictiveness

ASEAN = Association of Southeast Asian Nations.

Notes:

Mode 1 = financial services, mode 3 = all subsectors, mode 4 = professional services.

0 = completely open, 25 = virtually open with minor restrictions, 50 = major restrictions, 75 = virtually closed with limited opportunities to enter and operate, 100 = completely closed.

Source: Services Trade Restrictions Database (http://iresearch.worldbank.org/servicetrade/aboutData.htm, accessed 28 November 2014).

Many of the remaining challenges to realizing the AEC goals are tied to ASEAN’s ability to harness cooperation and commitment, and address the development divide among its members. ASEAN is home to some of the richest (Brunei Darussalam and Singapore) and poorest (Cambodia, the Lao People’s Democratic Republic, and Myanmar) economies in Asia. Strategies that will narrow the income gap and allow spillovers from richer, more technologically advanced members to least developed countries need to be strengthened and sustained. An important step is to develop modern, high-quality infrastructure that will enhance connectivity within the region. This will create vast opportunities for connecting markets and improving the physical mobility of people, goods, and knowledge within the region. Infrastructure investment needs in ASEAN for the next 2 decades are massive, requiring $60 billion each year until 2022. The energy and transport sectors make up 63% of the infrastructure needs (KPMG 2014). For Indonesia, Malaysia, the Philippines, and Thailand alone, a total investment of $523 billion in power and transport infrastructure is needed until 2020 (Goldman and Sachs 2013, 4–5). Close coordination and cofinancing from ASEAN governments, the private sector, and development banks are important to meet ASEAN’s infrastructure financing needs.

What is next?

The AEC project has been crucial for moving ASEAN from its beginnings as a political grouping in 1967 to becoming one of the most dynamic regional economic blocs in the developing world. The solidarity and enthusiasm shown by ASEAN members in trying to meet the AEC goals are notable. Visible progress has been achieved in implementing the first pillar (particularly in reducing tariffs for goods trade and implementing single windows for better trade facilitation) and the fourth pillar (in signing regional FTAs for improved trade rules). However, it seems likely that the December 2015 deadline for realizing all four pillars of the AEC will be missed. The AEC project will remain a work in progress for the foreseeable future.

Rather than playing a blame game as to why the deadline will be missed, it will be useful to do three things during Malaysia’s chairmanship of ASEAN in 2015: First, ASEAN members should undertake a quick and dirty but honest stocktaking exercise of achievements under the AEC project and a short report should be published by the ASEAN Secretariat. Second, ASEAN members should focus on a few important next steps for the AEC project and get them done in a reasonable time frame, say by 2020. In this vein, reducing restrictions on trade in services and monitoring NTMs are priorities under the first pillar. Financing and implementing a few key infrastructure projects to reduce development gaps between richer and poorer ASEAN economies is important under the third pillar. Third, ASEAN members should give serious consideration to increasing the capacity of the ASEAN Secretariat. A reasonable increase in the ASEAN Secretariat’s budget and technical skills seems warranted to support effective implementation of the AEC agenda. While the AEC project may take longer than originally envisaged, with sustained cooperation and commitment among ASEAN economies it will not remain impossible.

_____

References:

ASEAN Secretariat. 2008. ASEAN Economic Community Blueprint. (accessed 28 November 2014).

KPMG. 2014. An Overview of Infrastructure Opportunities in ASEAN. (accessed 28 November 2014).

Goldman and Sachs. 2013. ASEAN’s Half a Trillion Dollar Infrastructure Opportunity. Asia Economics Analyst, Issue No. 13/18. (accessed 28 November 2014).

Wignaraja, G. 2014. The Regional Comprehensive Economic Partnership: An Initial Assessment. In P. Petri and T. Guoqiang (eds.) New Directions in Asia-Pacific Economic Integration, Honolulu: East-West Center. (accessed 28 November 2014).

Comments are closed.