In December 2012, Japan’s Liberal Democratic Party won the general election, making Shinzo Abe Prime Minister of Japan, a post that he had previously held in 2007. “Abenomics” refers to the economic policies advocated by the prime minister after the election, which were designed to revive the sluggish economy with “three arrows”: (i) fiscal consolidation, (ii) more aggressive monetary easing by the Bank of Japan, and (iii) structural reforms to boost Japan’s competitiveness and economic growth.

Fiscal Consolidation

Japan’s debt/gross domestic product (GDP) ratio is the highest among Organisation for Economic Co-operation and Development (OECD) countries, yet its economy is still sustainable. Although Greece’s government debt/GDP ratio is lower than Japan’s, Greece almost went bankrupt in 2012. The differences between the two countries can be seen in the demand for government debt; more than 90% of Japanese government debt is held by domestic investors, whereas around 70% of Greek government debt is held by overseas investors (Yoshino and Taghizadeh-Hesary 2014a).

More Aggressive Monetary Easing by the Bank of Japan

On 22 January 2013, the government and the Bank of Japan (BOJ) delivered a joint statement on overcoming deflation and achieving sustainable economic growth. The BOJ set the price stability target at 2% (year-on-year rate of change in the consumer price index). The government expects the BOJ to implement aggressive monetary easing to achieve this target as soon as possible. The BOJ is buying long-term government bonds and increasing the monetary base, in contrast to previous attempts at expansionary monetary policy that mainly focused on buying short-term government bonds. Although prices started to rise after the BOJ implemented monetary easing, the main reason for this was higher energy prices due to the depreciated Japanese yen (Yoshino and Taghizadeh-Hesary 2014b), and at present the 2% target has not been achieved.

Growth Strategy

The third arrow of Abenomics is growth strategy. Over the medium and long term, the Japanese government will take measures to strengthen the competitiveness of the economy, overcome energy constraints, and enhance the innovation platform based on a well-defined growth strategy, while at the same time accelerate the removal of domestic institutional obstacles, including regulations. As the easing of monetary policy has not had a significant impact on boosting economic growth, this arrow could provide a remedy for the Japanese economy.

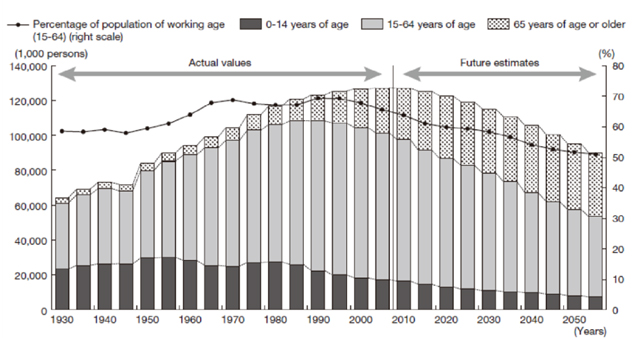

Figure 1 shows that the working population, represented by the middle portion of each column, is diminishing drastically, and the elderly population, the top portion, is growing very rapidly.

Figure 1: Population Structure of Japan

Source: Yoshino (2013).

One policy proposal we recommend, therefore, is to postpone the retirement age in order to increase the working-age section of each column and reduce the top portion. Another recommendation is to base wage rates on productivity rather than seniority, as is traditionally the case in most Japanese firms.

The third policy proposal we recommend is to change the Japanese pension system to a 401(k) style. Japanese pension funds and insurance companies mainly invest in government bonds and are cautious about investing in stocks. One of the reasons for this is that Japanese public and traditional corporate pension funds are pay-as-you-go style, and pension contributors cannot control how their funds will be invested. By contrast, most United States pensions are 401(k)-style and contributors are responsible for choosing their allocations from risky and safe assets. In this case, the asset manager’s job is easy. If all the funds are aggregated, x% will be invested in risky assets and 1-x% will be allocated among safer assets. In Japan, there is complete reliance on asset managers’ decisions, and no self-responsibility with regard to pension funds and insurance companies. Hence, asset managers prefer to invest in government bonds as they are the safest assets. If Japan’s pensions change to a 401(k)-style contribution sy

stem and asset allocation depends on individual decisions about portfolio allocation, then stock market investment and overseas investment in stocks should become more likely options (Yoshino and Taghizadeh-Hesary, forthcoming).

A fourth policy proposal is a new form of financing, the hometown investment trust fund, which has been proposed to the Japanese government mainly by Naoyuki Yoshino (Yoshino 2013). The goal of the fund is to connect investors with their hometowns and a committee at the Cabinet Office has been created to study the proposal.

Given the bank-dominated financial system in Japan, the creation of regional funds (or hometown investment trust funds) to promote lending to start-up companies and riskier borrowers such as small and medium-sized enterprises (SMEs) would help to maintain the soundness of the banking sector, as banks would not be exposed to the risks that lending to such companies inevitably poses. If these regional trust funds were sold through branch offices to regional banks, post offices, credit associations, and large banks, this would increase the opportunities for regional companies to raise funds.

However, such trust funds would not be guaranteed by the Deposit Insurance Corporation and risks would be borne by investors. The terms of a trust fund would have to be fully explained to investors (e.g., where their funds would be invested and what the risks associated with the investments would be) in order to strengthen trust fund investors’ confidence and help the trust fund market to grow (Yoshino 2013). Such funds include funds for wind power generators and musicians. For example, in Japan, private–public partnerships were launched and local residents invested $1,000–$5,000 in a fund to construct 20 wind power generators. Every year, investors receive dividends from the sales of electricity from the wind power generators. Similarly, musicians’ funds gather many small investors to invest between $150 and $500 in musicians. If a musician becomes successful and their music sells well, the sales will generate a high rate of return for the fund. Examples can be found of both successful and failed funds, and project assessors play a key role in evaluating each project to limit the number of nonperforming investments and reduce losses for investors.

In conclusion, monetary policy in Japan has had little impact on stimulating investment and aggregate demand. Instead, the Government of Japan should focus on the four policy proposals discussed in order to bring about structural change and growth.

_____

References:

Yoshino, N. 2013. The Background of Hometown Investment Trust Funds. In N. Yoshino and S. Kaji, eds. Hometown Investment Trust Funds: A Stable Way to Supply Risk Capital. Tokyo: Springer.

Yoshino, N., and F. Taghizadeh-Hesary. 2014a. Three Arrows of “Abenomics” and the Structural Reform of Japan: Inflation Targeting Policy of the Central Bank, Fiscal Consolidation, and Growth Strategy. ADBI Working Paper 492. Tokyo: Asian Development Bank Institute.

Yoshino, N., and F. Taghizadeh-Hesary. 2014b. Effectiveness of the Easing of Monetary Policy in the Japanese Economy, Incorporating Energy Prices. ADBI Working Paper 503. Tokyo: Asian Development Bank Institute.

Yoshino, N., and F. Taghizadeh-Hesary. Forthcoming. An Analysis of Challenges Faced by Japan’s Economy and Abenomics. Japanese Political Economy Journal.

Comments are closed.