Cross-border e-commerce is booming in the Asia and Pacific region. And exchange rate fluctuations play a key role in these transactions. In their quest for the best deals, consumers in the region are taking advantage of exchange rate movements, and shop abroad whenever the exchange rate is favorable. Our research proves that short-term international price arbitrage is occurring—an important finding for monetary policy and the private sector (Anson, Boffa and Helble 2014).

In 2013, the Asia and Pacific region rang up $433 billion in e-commerce sales, or one-third of the global total, and outperformed North America.1 The growth has been particularly strong in cross-border e-commerce transactions. More consumers and producers are shopping online to arbitrage between prices offered by local businesses—either brick-and-mortar or domestic online shops—and by online shops worldwide.

Cross-border e-commerce is common in the developed countries of the Asia and Pacific region where internet use is widespread and shipping costs are low. For example, in fiscal year 2011–2012, Australian consumers bought more goods (US$6.4 billion) from overseas online shops than from domestic online retailers (US$4.7 billion).2 This trend is expected to continue as internet access spreads and as more shops go online.

Conditions needed for arbitrage

For international arbitrage to happen transport costs must not be excessive, undoing possible price differentials between domestic and foreign goods. International logistics’ chains are highly efficient—handling and shipping costs account for only a small fraction of the price of a good. Once international transport costs are taken into account, the key exogenous determinants of international arbitrage are exchange rate movements. As prices adjust relatively slowly to exchange rate movements, sudden variations of exchange rates open up the possibility of international arbitrage in cross-border e-commerce transactions.

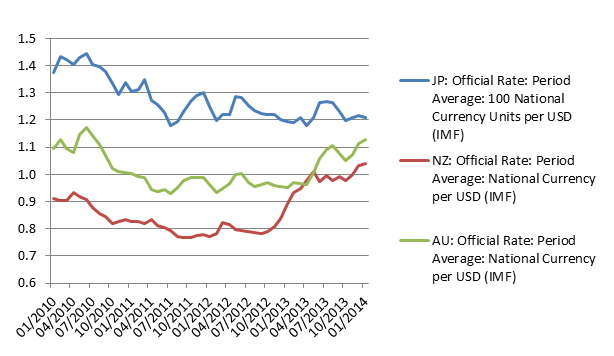

Following the 2008 global financial crisis, exchange rate movements began to strongly fluctuate because of expansionary monetary policies adopted by key central banks. Another reason was that the global financial crisis affected countries differently. Figure 1 shows the sizable exchange rate movements experienced by Australia, Japan, and New Zealand. Given the well-established empirical result that prices are sticky in the short term, these strong exchange rate movements have thus opened up the possibility of short-term international price arbitrage for these countries and their trade partners.

Figure 1: Monthly Exchange Rates of AUD, NZD, JPY to USD

(January 2010 to January 2014)

Source: Author’s calculations, based on IMF IFS data.

Short-term international arbitrage is interesting from an economic theory perspective, and it is also relevant to monetary policy. Expansionary monetary policy typically aims at enhancing international competitiveness while boosting exports and slowing imports. For the latter to occur, short-term international arbitrage is key. Despite its importance, empirical evidence on short-term international arbitrage is scarce for data reasons. Whereas data on daily international exchange rates are available, there is a lack of short-term (daily or weekly) trade data or similar data that would allow the approximation of the flow of goods across borders.

An innovative method to overcome this data problem is presented in a new ADBI working paper where the authors use highly disaggregate and detailed data on parcel flows transported through the international postal network as a proxy for short-term trade flows. (International parcel exchanges are recorded in real-time through an electronic data interchange system to allow for traceability from origin to destination.) These parcel flows are highly correlated with monthly trade flows in product categories most present in international e-commerce. Merging these daily parcel exchanges with daily exchange rates allows for the testing of short-term international arbitrage.

E-commerce depends on floating exchange rates

Internet usage in Australia, Japan, and New Zealand is high and e-commerce is common. At the same time, the three countries have freely floating exchange rate regimes—if this was not the case, arbitrage might be more difficult, for example in the case of a fixed exchange rate regime. And, as Figure 1 shows, the exchange rates have been fluctuating considerably over the past several years.

Applying a Vector Error Correction (VER) model designed for panels with large time and group dimension to the data set of Australia, Japan, and New Zealand, Anson et al. (2014) find strong evidence that short-term international arbitrage is occurring. The empirical results suggest that a 1% currency appreciation triggers an increase of postal inflows by the magnitude of 0.6%. Favorable exchange rate movements thus seem to stimulate trade in the short term.

These results are important for the Asia and Pacific region for three reasons. First, as the most dynamic region for e-commerce, a better understanding of the behavior of online consumers and producers when faced with exchange rate swings is crucial. Second, the results show that expansionary monetary policy can impact short-term trade flows, especially when international search costs and shipping costs are low. Given the rise of internet usage, this effect will become more prominent in the near future. Third, in several developing countries in the region, most importantly in the People’s Republic of China, e-commerce is surging and replacing traditional brick-and-mortar businesses much faster than in the developed world.3 Consumers in these countries are not limiting their shopping to the domestic market, but are shopping across the region and the globe. A better understanding of their reaction to exchange rate swings is therefore becoming increasingly important, not only for the private sector, but also for central banks.

_____

1 Emarketer. 2013. Ecommerce Sales Topped $1 Trillion for First Time in 2012, 5 February. Available at: www.emarketer.com/Article/Ecommerce-Sales-Topped-1-Trillion-First-Time-2012/1009649#xHlPSA4ku2aIQ13i.99

2 Australian Bureau of Statistics. 2013. Information Paper: Measurement of Online Retail Trade in Macroeconomic Statistics. Accessed: www.abs.gov.au/ AUSSTATS/[email protected]/Latestproducts/8501.0.55.007Main%20Features12013?opendocument&tabname=Summary&prodno=8501.0.55.007&issue=2013&num=&view=

3 Dobbs, R. et al. 2013. China’s E-Tail Revolution. McKinsey Global Institute. March. March 2013. Accessed: www.mckinsey.com/insights/asia-pacific/china_e-tailing

References:

Anson, J., Boffa, M., and M. Helble. 2014. A Short-run Analysis of Exchange Rates and International Trade. ADBI Working Paper No. 471. Tokyo: Asian Development Bank Institute.

Comments are closed.