The People’s Republic of China’s (PRC) economy has shown signs of overheating despite a sharp slowdown in economic growth, suggesting that, constrained by the supply of labor, its potential growth rate might have fallen significantly from its past level. With the priorities of the PRC’s authorities shifting from raising economic growth to curbing inflation, they are expected to change their stance on macroeconomic policy, including monetary policy, from easing to tightening. As a result, the PRC economy is likely to slow in 2014.

Differences between the current and the previous recession

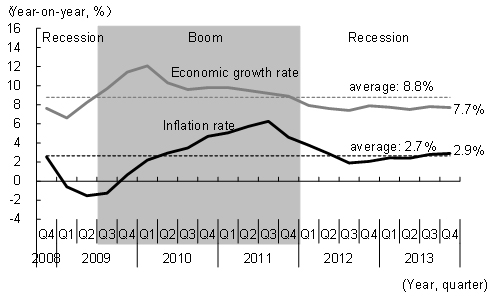

Since the collapse of Lehman Brothers in 2008, the PRC’s annual growth rate has averaged 8.8% (fourth quarter of 2008 to fourth quarter of 2013). Using this figure to mark the boundary between a “recession” and a “boom,” the economy has moved from a recession (fourth quarter of 2008 to second quarter of 2009, with the growth rate falling below 8.8%) to a boom (third quarter of 2009 to fourth quarter of 2011, with the growth rate rising above 8.8%), and then back to a recession (first quarter of 2012 to fourth quarter of 2013, with the growth rate falling below 8.8% again) during this period (Figure 1).

Figure 1. Changes in Economic Growth and Inflation Rates in Post-Lehman PRC

Compiled by Nomura Institute of Capital Markets Research based on CEIC database.

The current recession differs from the previous one in several ways. First, the current period shows signs of overheating. While the economy grew at about the same rate during the two recession periods, this time around inflation is averaging 2.6% per year compared to only 0.1% in the previous slowdown. Alongside the inflation rate, housing prices are also rising. The Price Indices of Newly Constructed Commercial Residential Buildings in 70 Medium and Large-sized Cities rose 9.7% on average in December 2013 compared with a year earlier, with indices for Shanghai and Beijing surging by more than 20%. This contrasts sharply with the previous recession period, when housing prices were falling.

Second, unemployment has not become a serious problem in the current downturn. In the recession following the collapse of Lehman Brothers, millions of migrants working in urban areas lost their jobs and had to return to their rural roots. The job-offers-to-job seekers ratio (number of job offers to number of job applicants) in urban areas fell to 0.85 in the fourth quarter of 2008. In the current recession period, however, this ratio has exceeded 1 consistently, reaching 1.10 in the fourth quarter of 2013. Thus, the labor market has remained tight, with demand for labor (represented by the number of job offers) surpassing supply (represented by the number of job applicants) by about 10%.

Finally, the current recession has been prolonged, with the growth rate staying at 7.7% in the fourth quarter of 2013. This contrasts sharply with the last recession, which was short-lived and followed by a V-shaped recovery, thanks to the four trillion yuan package undertaken by the government to stimulate domestic demand.

Sharp fall in PRC potential growth rate

These differences have a common explanation—a significant fall in the PRC’s potential growth rate as a result of the shift from labor surplus to labor shortage. The PRC’s working-age population (ages 15 to 59) started to decline in 2012, and the aging of the population is accelerating, as the country’s one-child policy, launched in 1980, has come back to haunt it. In addition, rapid industrialization and urbanization have almost entirely eliminated the surplus labor in rural areas that existed in the past, and the country seems to have reached the Lewisian turning point—or the achievement of full employment in the development process.1 The decline in the working-age population and the arrival of the Lewisian turning point imply that a fall in the PRC’s potential growth rate is inevitable.

First, the fact that the working-age population is beginning to decline means that the PRC’s demographic dividend has turned into a demographic onus. In the past, a growing working-age population meant an expanding supply of labor to the economy, and a high rate of savings in a youthful society led to more capital input, as domestic savings were the major source of investment funds. On the other hand, the decline in the number of people of working age and the progressively aging society will mean a smaller supply of labor and a lower saving rate, which will dampen the growth rate.

In addition, the arrival of the Lewisian turning point is also constraining growth. A seemingly unlimited supply of labor had been underpinning the PRC’s growth through the following channels. First, absorption of surplus agricultural labor by the industrial and service sectors directly contributed to the expansion of GDP. Second, the shift of labor from the agricultural sector where productivity is low to the industrial and the service sectors where productivity is higher increased the productivity of the overall economy. Third, by keeping wages low the labor surplus skewed the income distribution toward the high-income group with more capital, which in turn favored savings and investment. The achievement of full employment means the end of these advantages, and as a result the potential growth rate has started to fall.

The shift from an increasing to a decreasing working-age population and the shift from underemployment to full employment usually occur at different times during a country’s economic development. Japan, for example, had achieved full employment by the early 1960s, but its working-age population did not begin decreasing until around 1995. In the PRC, in contrast, these two turning points appear to have arrived at the same time, thus compounding the extent of the labor shortage and its resulting impact on the economy.

Judging from the current state of overheating, the PRC’s potential growth rate might have already fallen to around 7%, which is not only below the 8.8% average growth rate since the Lehman Brothers collapse, but also below the latest growth rate of 7.7%.

Tightening of monetary policy expected

In addition to the actual growth rate, the potential growth rate also serves as an important reference for policymakers when formulating macroeconomic policies. If the actual growth rate falls below the potential growth rate, the economy would dip into a recession, and they would ease monetary policy as a countermeasure. In the opposite case, the economy would overheat, and monetary policy would be tightened. If the authorities try to use expansionary policies to push the growth rate above the economy’s potential, a bubble could result.

In the early stage of the current recession, presuming that the economy’s actual rate of growth was below the potential, PRC monetary authorities tried to promote recovery by reducing the reserve requirement three times in December 2011, February 2012, and May 2012, and lowering interest rates twice after that, in June 2012 and July 2012. Since then, however, they have come to recognize—from the increasingly apparent overheating of the economy with no pick up in the rate of growth—that the potential growth rate has fallen, and have taken a more cautious monetary policy stance. To curb inflationary pressure, they may have to raise the statutory reserve requirement ratios and interest rates later this year, which may serve as a trigger for an economic downturn.

_____

1 The arrival of the Lewisian turning point does not mean that the flow of labor from rural areas to the urban areas is coming to an end. Rising productivity in the agricultural sector will allow further migration of peasants to urban areas (but only at a slower pace) without reducing the PRC’s self-sufficiency in food production.

Comments are closed.