Recent decades have witnessed a rapid expansion of production networks and supply chains in East and Southeast Asia, made possible by underlying forces of technological advances and reductions in trade barriers and driven by pursuit of economies of scale and agglomeration, and greater efficiency and lower costs. The successful functioning of such finely constructed and balanced production networks and supply chains rests, however, on the premise of there being no major disruptions to the system, including natural disasters.

Recent decades have witnessed a rapid expansion of production networks and supply chains in East and Southeast Asia, made possible by underlying forces of technological advances and reductions in trade barriers and driven by pursuit of economies of scale and agglomeration, and greater efficiency and lower costs. The successful functioning of such finely constructed and balanced production networks and supply chains rests, however, on the premise of there being no major disruptions to the system, including natural disasters.

Historical data indicate that the East and Southeast Asia region is, in fact, especially prone to a variety of natural hazards (earthquakes, tsunamis, floods, and typhoons). However, there has not been any systematic study of the impact of such hazards on the region’s economies and their development, built as they are on production networks and supply chains, although there is some evidence to indicate that the impact in 2011 was enormous.

Impact of natural disasters

The Great East Japan Earthquake (and the tsunami and nuclear accident that it precipitated) and the Thai floods in 2011 both caused enormous disruptions to production networks and supply chains in the region, and extensive damage to the economies concerned. The estimated direct global economic loss in 2011 due to natural disasters was $363 billion, making it the worst year in the recorded history. Of this, Asia and the Pacific region accounted for $351 billion, with the earthquake and tsunami in Japan in March accounting for $212 billion, and the floods in Thailand from June to December 2011 adding another $40 billion.

However, the true economic and human impacts of these disasters are likely to be much larger than these estimates. Through production networks, the impacts of a major disaster in one corner of the region can now be felt across the length and breadth of these networks.

In Japan, the most affected Tohoku region contains a significant portion of the country’s production base, responsible for close to 10% of general machinery and electrical machinery production, and accounting for 6.2% of the country’s total production capacity, as of 2008 (METI 2011). Disruptions caused by the disaster to other countries in the region were mainly related to the degree of dependence of these economies on Japan for parts and materials. In 2010 Indonesia, Malaysia, the Philippines, and Thailand taken together were among the most dependent economies on parts, components and industrial materials from Japan (imports 22% and exports 18%); followed by Republic of Korea (imports 25% and exports 6%); and Taipei,China (imports 29% and exports 7%).

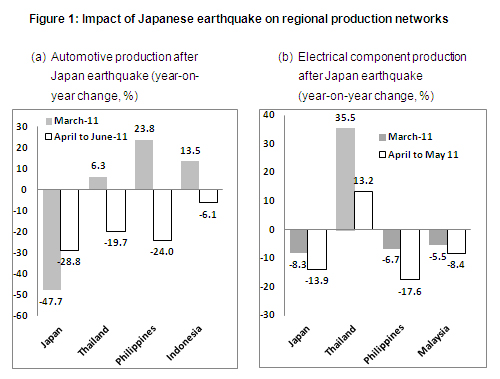

Disruptions in the supply of these intermediary products following the Tohoku earthquake meant that automotive production in Japan contracted by 47.7% and electrical components production by 8.3% (year-on-year) in March 2011. Contractions were also very evident for several other economies in the region. For the automotive sector, production contractions soon spread to the Philippines (-24%), Thailand (-19.1%) and Indonesia (-6.1%) during April to June 2011. For the production of electrical components, the highest contraction was likewise recorded by the Philippines (-17.5%), followed by Malaysia (-8.4%), during April to May 2011 (Figure 1)—all percentages are year-on- year.

Source: CEIC Data Company Limited (CEIC), 2012, Japan Manufacturing Production Index. Available from http://www.ceicdata.com/.

Note: Disruption from the Japanese earthquake lasted longer in the automotive sector (around 3 months) than in the electrical sector (around 2 months).

At the corporate level, for the largest automobile producer, Toyota, the main disruption to its production concerned the supply of spare parts from the manufacturers and suppliers based in the tsunami-affected Tohoku coastal areas. Many of its suppliers sustained severe damage to their production facilities, and also had to evacuate their staff because of radiation concerns. Toyota had to close all 12 of its factories in Japan, and suffered a loss of profits of Y6 billion ($73 million) on each day it halted production. The disruption also caused Toyota to lose its position as the world’s largest automaker for 2011. In fact, in the first half of the year, it fell to the third place, behind General Motors and Volkswagen.

Similarly, the disruptions caused by the Thai floods forced the production of the automotive sector in Thailand to contract by 45.8% and the electrical component sector by 15% from October 2011 to January 2012. During January to December 2011, significant declines in exports from Thailand were also recorded in the electronics (-47.4%) and electrical appliances (-21.9%) sectors. The Thai government revised down the GDP growth forecast for 2011 from 2.6% to 1.0%.

About 19% of manufacturing firms in Thailand take part in global production networks through the use of imported parts and components. Production stoppages in Thailand because of floods had significant impacts on Japan, where the manufacturing production index fell by 2.4% (from October 2011 to January 2012), led by a contraction in electrical component production of 3.7% during the same period.

At the corporate level, as a result of the floods, Nissan and Toyota had to suspend automobile production in their Thai plants due to difficulties in obtaining parts and components from suppliers. Toshiba was forced to halt production at nine plants in Thailand and Sony closed two of its three facilities in Thailand and delayed the launch of a new digital camera.

Thailand is the world’s second largest hard disk drive (HDD) producer after the PRC. The flooding closed two Western Digital plants in Thailand, and many other producers including Hitachi, Seagate, and Toshiba, were affected by the floods. As a result, the global HDD industry suffered its worst downturn in three years and the world price increased significantly.

Natural disasters and ways forward

The above short list of the impacts of the two major natural disasters in 2011 in the region on its economies through production networks comes nowhere close to a full counting of the indirect costs involved. In view of the frequency of natural disasters in Asia and the Pacific and the region’s increased economic vulnerability through supply chains and production networks, it is important that such impacts are closely studied. It is also critical that both governments and private companies adopt effective remedial measures, given the likely impacts. Among the measures being widely discussed are an appropriate relaxation of the just-in-time approach to input management, greater scope for multi-sourcing, and other business continuity plans in the event of a major disaster. These are likely to have strong cost implications, but this may be a price worth paying in the long run.

An improvement in disaster risk management programs in the region can reduce the scale of possible shocks to its economies and populations. A focus must be on making the right pre-disaster investments to improve adaptation, recovery and mitigation capability. It should include both soft and hard measures in the short and long run at the national, regional and global levels. Measures include developing early warning systems and risk quantification metrics, sharing of data and information, building trusted networks across business and governments, and shaping new legislation.

_____

Reference:

Ministry of Economy, Trade and Industry (METI). 2011. Japanese Industry-Lasting Change in Manufacturing Industry. March 2011.

Comments are closed.