The Bank of Japan (BoJ) announced its much-awaited new monetary policy framework on 22 January 2013, following heightened pressure from newly-elected Japanese Prime Minister Shinzo Abe for it to pursue “unlimited” monetary easing in order to finally overcome deflation. The new framework has two major elements: a “price stability target” of 2% for the consumer price index (CPI) and an “open-ended asset purchasing method” for its Asset Purchasing Program (APP). Although the BoJ did not commit itself to a deadline for achieving 2% inflation, it said that it would aim to achieve this target “as early as possible.”

The Bank of Japan (BoJ) announced its much-awaited new monetary policy framework on 22 January 2013, following heightened pressure from newly-elected Japanese Prime Minister Shinzo Abe for it to pursue “unlimited” monetary easing in order to finally overcome deflation. The new framework has two major elements: a “price stability target” of 2% for the consumer price index (CPI) and an “open-ended asset purchasing method” for its Asset Purchasing Program (APP). Although the BoJ did not commit itself to a deadline for achieving 2% inflation, it said that it would aim to achieve this target “as early as possible.”

The main innovation of the “open-ended” purchasing method is that the BoJ does not set a target date for ending the program, unlike previous programs. However, the bottom line is that the APP will continue to focus its purchases on “traditional assets,” almost wholly Japanese government bonds (JGBs) and Treasury bills (T-bills). Given that interest rates are already very low (the 10-year JGB yield is about 0.7% to 0.8%), any stimulative effect from such purchases is likely to be small. Therefore, there is a basic disconnect between the BoJ’s inflation target and the means that it has chosen to achieve the target. This means that the BoJ is effectively shifting the burden to the government to implement structural changes that would enable underlying growth to strengthen to such a degree that 2% inflation would be achievable.1 If the government does not come through, the BoJ’s current policy stance could last a long time indeed. Presumably, any further monetary policy innovations will have to wait for the appointment of the next BoJ governor in April.

The price stability target

Notably, the BoJ chose the term “price stability target” rather than “inflation target,” indicating its continuing aversion to any terminology that might smack of encouraging inflation. This did mark a significant shift from its previous “goal” of CPI inflation of 1% within an overall range of price stability of 0% to 2%. The adoption of the 2% target clearly reflected pressure from the government—had the BoJ not adopted the target, the government had threatened to amend the BoJ law to incorporate such a target. Although some had suggested this amounted to undue interference with the BoJ’s independence, it is perfectly within the rights of governments to set a target range for inflation, and indeed many governments have done so. The BoJ retains its independence to choose policy instruments needed to achieve the target.

The novel aspect of the current arrangement is that in other countries the inflation target was set as a means to reduce inflation, not raise it. There is no recent example of a country setting a target of higher inflation, especially when that inflation rate has not been seen for over 20 years. (The inflation rate rose above 2% in 1997, but that was due to the two percentage point hike in the consumption tax at the time.)

Indeed, the BoJ’s statement suggested that it had swallowed the 2% target with some difficulty. The statement noted that the BoJ “recognizes that the inflation rate consistent with price stability on a sustainable basis will rise as efforts by a wide range of entities toward strengthening competitiveness and growth potential of Japan’s economy make progress” (BoJ 2013b:1). However, it gave little reason for why it might expect such a significant rise in the inflation rate, strengthening the impression that it caved into political pressure on this point. The BoJ Policy Board’s median forecast is that CPI inflation will jump from 0.4% in FY2013 to 2.9% in FY2014 (year ending April 2015), but this mainly reflects the impact of the scheduled increase of the consumption tax from 5% to 8% in April 2014, as it estimates that underlying inflation would only be 0.9%. Given that the BoJ expects GDP growth of only 0.8% in FY2014, there is not much basis for expecting underlying inflation to increase much in the near term. It is difficult to conclude from these points that the BoJ has much faith that its CPI target can be achieved any time soon. Moreover, the BoJ presumably has the option of revising its view of price stability if the government fails to come through with sufficient reforms and other measures to make the new target viable.

Open-ended Asset Purchasing Method

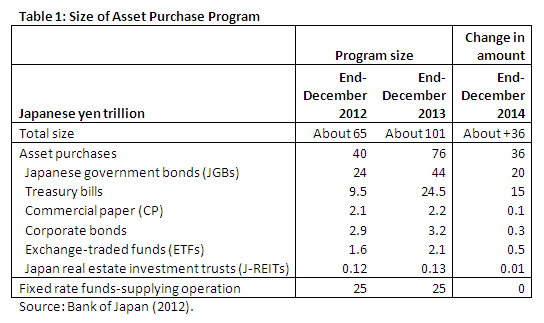

Against some expectations, the BoJ made no change in its asset purchasing program for 2013. The BoJ continues to plan for a net increase of its assets of ¥36 trillion in the year ending in December, which would raise its total assets in the program to about ¥101 trillion (see Table 1). The increase comes almost entirely from purchases of JGBs and T-bills, the most conservative category of assets.

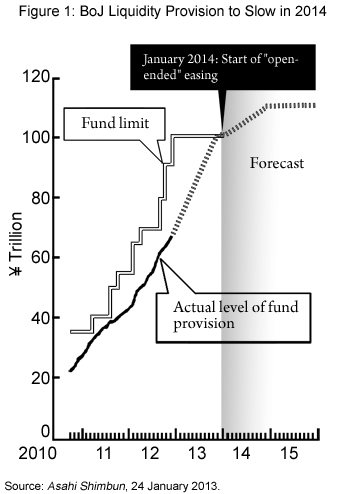

Beginning in 2014, the BoJ announced plans to make monthly asset purchases of about ¥13 trillion, including ¥10 trillion of T-bills and ¥2 trillion of JGBs. The emphasis on T-bills shows that the purchases will continue to be concentrated in the short end of the yield curve, where they are least likely to have a real sector impact, since yields on T-bills are essentially zero.2 The incremental effect of the “open-ended” program as announced would only be a further increase in program assets of ¥10 trillion by the end of 2014, i.e., less than one-third of the increase this year (see Figure 1). Moreover, the BoJ indicated that, under the announced program, bond holdings would level off by the end of 2014 as a result of increasing redemptions. Even more notably, holdings of assets other than JGBs and T-bills are not expected to rise at all. “For financial assets other than JGBs and T-bills, the Bank will aim to maintain the amount outstanding of those assets” (BoJ 2013a:10). Because the stimulative effect of alternative assets would likely be larger than those of JGBs or T-bills, this provides further evidence of the underlying conservatism of the BoJ’s “new” policy.

Furthermore, there was no evidence of any intention by the BoJ to buy foreign bonds as a way of weakening the yen. This is not surprising, given that such purchases would effectively be currency intervention, which, under the Bank of Japan Law, is the responsibility of the Ministry of Finance (MoF), not the BoJ. Therefore, such purchases would need the advance approval of the MoF. Given the likelihood that a deliberate policy of yen weakening would not be welcomed by Japan’s trading partners, such approval is not likely in the near future. In any event, the yen has weakened significantly in recent months, so its level is much less of a concern than previously.

Implications of new framework

The BoJ has adopted an ambitious new inflation target of 2%, but there is a basic disconnect between the target and the policy tools being used, so there are few grounds for expecting it to be achieved any time soon based on these announcements. First, there is no deadline or penalty for not achieving the target, so the BoJ has no incentive to deviate much from the policy path it has pursued to date. It can simply wait, hoping that inflation will gradually pick up as a result of policies implemented by the government. Second, the “open-ended” purchase program sounds dramatic, but is in fact quite conservative. Its purchases will continue to be concentrated in T-bills, the net increase in its purchases in 2014 will be far less than in 2013, and the program is self-terminating, in that the level of assets will stabilize automatically by the end of 2014 as a result of increased bond redemptions.

Of course, the next BoJ governor, to be appointed in April, is likely to be selected partly on the basis of his or her commitment to more aggressive monetary easing measures. Therefore, we may expect additional easing measures to be announced later in the year. To be effective, the measures will have to move beyond JGB and T-bill purchases in a significant way.

In terms of implications for emerging Asia, it seems that fears of a competitive depreciation of the yen are overblown, at least for now. The burden is now on the Japanese government to implement far-reaching reforms to support higher rates of productivity growth. If successful, these will certainly augment Japan’s contribution to supporting growth in the region and the global economy. If not, then the combination of weak growth and mild deflation or near-zero inflation in Japan will probably continue.

_____

1 See, e.g., Kawai and Morgan (2012) for a description of needed structural changes.

2 Normally, it would be expected that a rise in the monetary base resulting from increased open market purchases by the central bank would lead to an increase in broader monetary aggregates and eventually be inflationary. However, it has long been known that, at zero interest rates, when the central bank purchases T-bills in exchange for increased reserve deposits at the central bank, it is essentially swapping “like-for-like” since both the purchased and sold asset effectively have zero rates. Therefore, there is no effective change in the liquidity of private banks’ balance sheets as a result of the operation, and no incentive for banks to increase lending. In other words, at zero rates, the demand for reserves becomes infinitely elastic. See, e.g., Woodford (2012).

References:

Bank of Japan. 2012. Enhancement of Monetary Easing. Tokyo: Bank of Japan. www.boj.or.jp/en/announcements/release_2012/k121220a.pdf (accessed 22 January 2013).

Bank of Japan. 2013a. Introduction of the “Price Stability Target” and the “Open-Ended Asset Purchasing Method.” Tokyo: Bank of Japan. www.boj.or.jp/en/announcements/release_2013/k130122a.pdf (accessed 22 January 2013).

Bank of Japan. 2013b. Introduction of the “Price Stability Target” and the “The ‘Price Stability Target’ under the Framework for the Conduct of Monetary Policy.” Tokyo: Bank of Japan. www.boj.or.jp/en/announcements/release_2013/k130122b.pdf (accessed 22 January 2013).

Kawai, M. and P. Morgan. 2012. Japan’s Post-Triple-Disaster Growth Strategy. ADBI Working Paper 376. Tokyo: Asian Development Bank Institute. Available: www.adbi.org/working-paper/2012/08/22/5218.japan.post.triple.disaster.growth.strategy/

Woodford, M. 2012. Methods of Policy Accommodation at the Interest-Rate Lower Bound. Paper presented at the Jackson Hole Symposium, “The Changing Policy Landscape,” 31 August to 1 September, 2012. Kansas City, Missouri: Federal Reserve Bank of Kansas City. www.kansascityfed.org/publicat/sympos/2012/mw.pdf (accessed 23 January 2013).

Comments are closed.