The economy of the Republic of Korea (henceforth Korea) has been on a steady growth path despite the global financial and eurozone crises. Recently, Fitch and S&P, the global credit rating agencies, upgraded Korea’s sovereign credit rating by one notch. Fitch’s rating for Korea, AA-, is the fourth-highest rating on its rating scale and a notch higher than those of the PRC and Japan.

The economy of the Republic of Korea (henceforth Korea) has been on a steady growth path despite the global financial and eurozone crises. Recently, Fitch and S&P, the global credit rating agencies, upgraded Korea’s sovereign credit rating by one notch. Fitch’s rating for Korea, AA-, is the fourth-highest rating on its rating scale and a notch higher than those of the PRC and Japan.

Notwithstanding these positive signs, Korea’s economy faces many internal and external challenges. One of the most serious is excessive household debt. Korea’s household debt has increased drastically since 2000. For the past 12 years, household debt has increased by an average of 13.3% every year, far in excess of the average annual nominal GDP growth rate of 6.2% during the same period. As of the end of 2011, Korean household debt amounted to W911.9 trillion (about US$787 billion) or 89.2% of GDP.

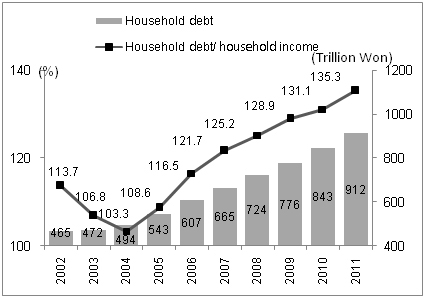

As debt is increasing more rapidly than income in the household sector amid already excessive levels of debt, household debt servicing capacities are weakening and the ratio of household debt to disposable income has grown consistently from 103.3% at the end of 2004 to 135.3% at the end of 2011(Figure 1).

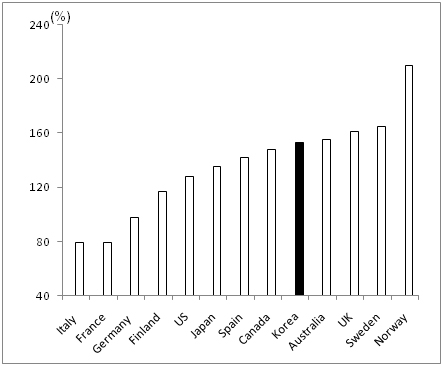

In order to conduct an international comparison of the debt servicing capacities of major economies, the Bank of Korea calculated ratios of household debts to disposable incomes for 13 major economies (Figure 2). To ensure the consistency of the index, household debt was calculated based on the individual sector’s financial debt from the flow of funds, and disposable income was calculated based on the individual sector’s net disposable income from the national accounts. Using this method, at the end of 2009, Korea’s household debt to disposable income ratio (153%) was higher than those of many developed economies, including the US(128%), Germany(98%) and Japan (135%).

In addition, at the end of 2010, the household debt to GDP ratio in Korea (89%) was higher than the average of OECD countries (78%) and Japan (82%), although it was still lower than the ratios in the US(97%) and the UK (106%).

Figure 1: Korea’s Household Debt

Source: The Bank of Korea

Figure 2: Household Debt to Disposable Income Ratios of Major Economies at the end of 2009

Source: Monetary Policy Report,Bank of Korea. September 2010.

Note: In Figure 1, official household debt data were provided by the Bank of Korea In Figure 2, in order to undertake an international comparison, Bank of Korea calculated household debt calculated based on the individual sector’s financial debt from the flow of funds, and disposable income based on the individual sector’s net disposable income from the national accounts.

Underlying factors of household debt problem

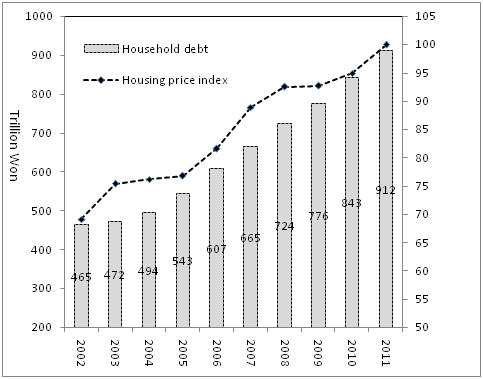

There are three main factors underlying the sudden hike in Korea’s house price and household debt. First, housing mortgage loans increased significantly during the real estate boom in the first decade of the century. Housing prices have increased significantly since the 1997–1998Asian financial crisis, growing particularly rapidly during 2001–2003 and 2005–2008 (Figure 3). The real estate boom encouraged people to borrow huge amounts of money to purchase houses. Currently, housing mortgage loans account for about 43% of total household liabilities. However, with the recent downside risks to housing prices in Seoul and its surrounding areas, there are fears of insolvencies among households which have borrowed excessively relative to their incomes in anticipation of house prices continuing to rise.

Figure 3: Housing Price Index and Household Debt

Source: Bank of Korea

Note: Housing price index is calculated based on 100 at the end of 2011.

Second, with the decrease in loan demand from the corporate sector after the 1997–1998 Asian financial crisis, competition among the banks to increase their asset size made them turn their attention to households. The huge liquidity supply during the low-interest-rate period of the early years of the century meant that financial institutions encouraged households to borrow to invest in real estate. Bank lending was supplemented by a rapid increase in borrowing from nonbank financial institutions, which also contributed to a hike in the total household debt.

Third, a slowdown in the disposable income growth rate and savings rate after the Asian¬ financial crisis also contributed to the rapid increase in household debt as households struggled to maintain their standard of living.

Future prospects and policy measures

The potential risk underlying Korea’s excessive household debt is significant because of the continued global economic slowdown and the recent weakness in the property market. In particular, much of the recent increase in household debt has been due to borrowing by low-income groups and also by people over 50.

Despite the huge levels of household debt, Korea does not seem likely to face a large-scale systemic problem at least for now. The growth rate of household debt has been slowing since the second half of 2011 as the government has long recognized the problem and introduced a number of policy measures to curb levels of household debt. Among others, in June 2011, the government introduced comprehensive measures, including properly managing total liquidity, improving households’ ability to repay their debts, strengthening financial institutions’ soundness, and reinforcing microfinancing programs.

More importantly, delinquency rates on household loans are still very low at 0.7% at the end of 2011. The loan-to-value ratios of mortgage loans are also very low. In addition, although lending to lower-income groups has increased in recent years, about 70% of household debt is still held by high-income groups.

Although levels of household debt do not seem to pose a high level of overall systemic risk at this point, it is essential for the government to adopt a series of precautionary measures in order to prevent the current household debt problem from developing into potentially systemic risks. For this purpose, it needs to strengthen macro-prudential policies to maintain the soundness of financial institutions and a stable financial market. It also needs to introduce measures to stabilize the real estate market to prevent a sudden housing market crash. And to enhance the ability of indebted people to repay their debts, the government needs to introduce structural measures to increase family income levels, such as creating new jobs for youth, providing incentives to create new businesses, and providing microfinance for low-income households.

A good reference in determining state of affairs and applying corrective measuring activities more importantly capability building exercises.

This is a good reference material for other countries to determine their respective status and apply corrective measures by way of capability building activities.