The international dollar standard is malfunctioning. The Fed’s reduction of the interest rate on Federal Funds to virtually zero in December 2008 (a move that was followed by major European central banks) exacerbated the wide interest rate differentials with emerging markets and provoked world monetary instability by inducing massive hot money outflows by carry traders into Asia and Latin America. The disruption could be partially justified if it had helped the United States recover from the 2008–2009 financial crisis. However, evidence suggests otherwise.

The international dollar standard is malfunctioning. The Fed’s reduction of the interest rate on Federal Funds to virtually zero in December 2008 (a move that was followed by major European central banks) exacerbated the wide interest rate differentials with emerging markets and provoked world monetary instability by inducing massive hot money outflows by carry traders into Asia and Latin America. The disruption could be partially justified if it had helped the United States recover from the 2008–2009 financial crisis. However, evidence suggests otherwise.

What causes world monetary instability?

Speculative money flooding into emerging markets by “carry traders” causes local currencies to be overvalued. When emerging market currency exchange rates are not tied down by official parities, their endogenous ongoing appreciation induces more hot money inflows. Speculators see a double benefit: the higher emerging market interest rates combined with their currencies appreciating against the dollar.

To prevent their currencies from appreciating, emerging market central banks intervene to buy dollars. With persistent carry trades, however, emerging market central banks are forced to keep intervening to prevent unlimited appreciation. This leads to the violation of the theorem that a floating exchange rate gives monetary independence to central banks.

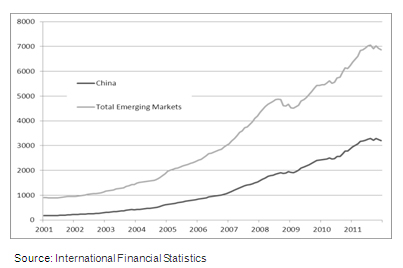

From 2001 to 2011, interventions by central banks in emerging markets were massive: emerging market foreign exchange reserves increased from $1 trillion to $7 trillion during the period (Figure 1). Although the People’s Republic of China (PRC) accounted for about half of this huge buildup, the combined interventions of large emerging markets—Brazil, India, Indonesia, and Russia—were equally important.

Figure 1: Emerging Markets and the PRC, Foreign Exchange Reserves ($ billion)

The sharp buildup of emerging market foreign exchange reserves was too big to be fully offset by domestic monetary sterilization. The resulting loss of monetary control in the emerging markets has led to inflation that is generally higher than that in developed market economies. This higher inflation occurred despite the fact that, since 2002, emerging market currencies on average appreciated against the currencies of developed countries.

How is the US economy constricted?

Conventional thinking has it that the lower the interest rate the more opportunities there are for credit to expand. But this is only true when interest rates—particularly interbank interest rates—are comfortably above zero. Banks with good retail lending opportunities typically lend by opening credit lines to non-bank customers. But these credit lines are open-ended in the sense that the commercial borrower can choose when—and by how much—to draw on the credit line (subject to some maximum limit of course). This creates uncertainty for the bank since it is difficult to know what its future cash positions will be. An illiquid bank could be in trouble if its customers simultaneously decided to draw down their credit lines.

However, if the “retail” bank has easy access to the “wholesale” interbank market, its liquidity is much improved. To cover unexpected liquidity shortfalls, it can borrow from banks with excess reserves with little or no credit checks. But if the prevailing interbank lending rate is close to zero (as it is now), then large banks with surplus reserves become loath to part with these reserves for a derisory yield. In this case smaller banks, which collectively are the biggest lenders to small and medium-sized enterprises (SMEs), cannot easily bid for funds at an interest rate significantly above the prevailing interbank rate without inadvertently signaling that they might be in trouble, i.e., distressed borrowers. Indeed, counterparty risk in smaller banks remains substantial as can be seen by the failure of about 100 banks in the United States in 2011.

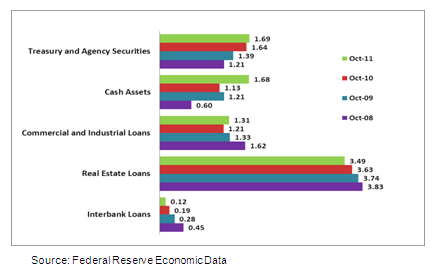

The US system of bank intermediation is essentially broken. This is reflected in the sharp fall in interbank lending: Interbank loans outstanding in October 2011 were only one-quarter of their level in October 2008. The US recovery has been weak into 2012 with bank credit and employment languishing or increasing only slowly.

Figure 2: Holdings of Bank Assets at Commercial Banks in the US ($ trillion)

What is the solution?

Reform efforts should focus much more on international monetary harmonization that limits interest rate differentials while accepting the need for exchange rate buffers, such as capital controls, to limit hot money flows.

If interest rate differentials are too wide, capital controls will always fail. The first item on the G-20 agenda should be to abandon current monetary policies by the mature industrial economies, led by the US, which set interest rates near zero. This would lessen the incentive of central banks in emerging markets to keep their interest rates low despite the inflationary pressure that they face and despite the fact that their “natural” rates of interest are higher. The Fed must be the leader in raising interest rates in mature economies because, under the asymmetrical world dollar standard, it has the greatest autonomy in monetary policy.

US officials point to the stagnant US economy as the reason they want to keep domestic interest rates as low as possible—even zero. They must be convinced that this common view is mistaken, and that raising short-term interest rates on dollar assets from zero to modest levels is in America’s best interests—as well as that of the rest of the world. The longer the Fed’s zero interest rate policy stays in place, the more difficult it becomes to get out of the resulting liquidity trap and restore a more normal flow of bank intermediation within the US. Without more lending to US SMEs, the US economy will continue to stagnate.

_____

References:

McKinnon, R. 2012. The Unloved Dollar Standard: From Bretton Woods to the Rise of China. Oxford University Press, forthcoming.

McKinnon, R. 2009. Zero Interest Rates and the Fall in U.S. Bank Lending. Journal of Economic Asymmetries.

Definitely more lending is needed to SMEs in the US. Something needs to be done to kick start an economy stuck in the doldrums.